Exploring the Benefits of Purchasing Blue VAT Products for Business Growth

Understanding the Benefits of Buying Blue VAT Products

In the world of taxation and commerce, Value Added Tax (VAT) stands as a significant factor influencing consumer behavior and business operations. Among various categories and colors associated with VAT, blue VAT products have emerged as a popular choice for consumers and businesses alike. This article delves into the concept of blue VAT products, their advantages, and the reasons why purchasing these items can be beneficial.

What is Blue VAT?

Blue VAT refers to a specific category of products that are supplied at a reduced VAT rate or are exempt from VAT altogether. This could be due to various factors such as government policies aimed at encouraging certain sectors of the economy, protecting consumers, or providing relief during economic downturns. Typically, essential goods like food items, medical supplies, and educational materials often fall under favorable VAT treatment, thereby being classified as blue VAT products.

Benefits of Buying Blue VAT Products

1. Cost Savings One of the most immediate benefits of purchasing blue VAT products is the potential for considerable cost savings. With a lower tax rate or no VAT applied, consumers find that their overall expenditure decreases. This is particularly advantageous for families or individuals on a fixed budget, allowing them to allocate funds for other necessities.

2. Stimulus for Essential Goods The categorization of certain items as blue VAT products often indicates a government intent to stimulate consumption in critical sectors. By reducing the financial burden associated with essential goods, governments encourage consumers to procure items vital for their daily life, thereby supporting overall economic stability and growth.

3. Encouraging Sustainable Practices In some jurisdictions, blue VAT products are linked to environmentally friendly practices. For instance, products that promote sustainability—such as biodegradable materials or energy-efficient appliances—may benefit from reduced VAT rates. By purchasing these items, consumers are not only saving money but also contributing to a greener planet.

buy vat blue 1

4. Support for Local Businesses Many times, blue VAT categories are employed to support local producers and manufacturers. When consumers opt to buy blue VAT products, they are often purchasing goods made by local entities, which helps sustain community businesses and bolsters the local economy. Such support can be critical during economic downturns, as it allows businesses to thrive and retain employment.

5. Increased Accessibility The reduced prices associated with blue VAT products can make essential items more accessible to low- and middle-income consumers. This accessibility helps ensure that all segments of society can afford the goods and services they need, thereby improving the quality of life across communities.

6. Simplification in Tax Reporting For businesses, engaging in the sale of blue VAT products can simplify the tax reporting process. With clear directives concerning the tax treatment of these products, businesses can manage their financial activities more efficiently, minimizing the risk of tax-related errors and ensuring compliance with governmental regulations.

Potential Drawbacks and Considerations

Despite the numerous benefits associated with blue VAT products, there are considerations to keep in mind. Some may argue that reduced VAT can often lead to a perception of lower quality associated with such goods. Furthermore, while these products save money for consumers, businesses may cope with the loss of revenue due to lower tax rates. It’s crucial for consumers to remain informed about the quality and viability of products, ensuring they do not compromise on standards while seeking cost-effective solutions.

Conclusion

The concept of blue VAT products presents an intriguing interplay between fiscal policy and consumer behavior. By understanding the advantages of purchasing these items, consumers can make informed decisions that not only benefit their wallets but also support local economies and promote essential practices. Whether you are looking for cost savings, environmentally friendly options, or supporting community businesses, blue VAT products are indeed a viable choice that offers multiple layers of benefits. As consumers, it’s essential to stay informed about the products available and to leverage these opportunities strategically in today’s dynamic market landscape.

-

The Timeless Art of Denim Indigo Dye

NewsJul.01,2025

-

The Rise of Sulfur Dyed Denim

NewsJul.01,2025

-

The Rich Revival of the Best Indigo Dye

NewsJul.01,2025

-

The Enduring Strength of Sulphur Black

NewsJul.01,2025

-

The Ancient Art of Chinese Indigo Dye

NewsJul.01,2025

-

Industry Power of Indigo

NewsJul.01,2025

-

Black Sulfur is Leading the Next Wave

NewsJul.01,2025

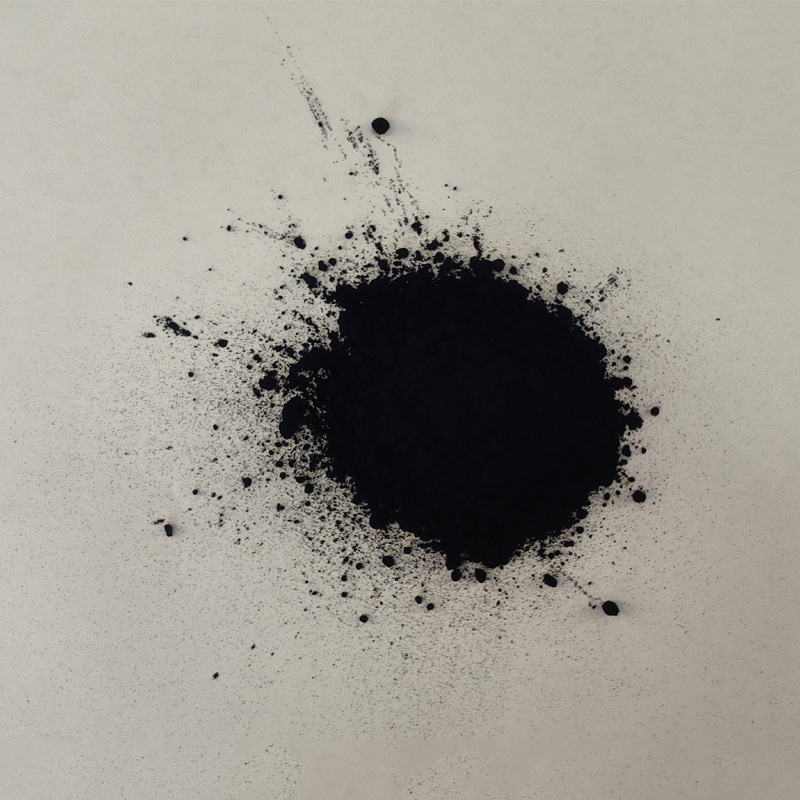

Sulphur Black

1.Name: sulphur black; Sulfur Black; Sulphur Black 1;

2.Structure formula:

3.Molecule formula: C6H4N2O5

4.CAS No.: 1326-82-5

5.HS code: 32041911

6.Product specification:Appearance:black phosphorus flakes; black liquid

Bromo Indigo; Vat Bromo-Indigo; C.I.Vat Blue 5

1.Name: Bromo indigo; Vat bromo-indigo; C.I.Vat blue 5;

2.Structure formula:

3.Molecule formula: C16H6Br4N2O2

4.CAS No.: 2475-31-2

5.HS code: 3204151000 6.Major usage and instruction: Be mainly used to dye cotton fabrics.

Indigo Blue Vat Blue

1.Name: indigo blue,vat blue 1,

2.Structure formula:

3.Molecule formula: C16H10N2O2

4.. CAS No.: 482-89-3

5.Molecule weight: 262.62

6.HS code: 3204151000

7.Major usage and instruction: Be mainly used to dye cotton fabrics.