Exploring VAT Implications for Indigo Blue Exporters in the Global Market Landscape

Exploring the Dynamics of Indigo Blue Exporting and VAT Implications

Indigo blue, a color synonymous with depth and tradition, has a long-standing history in the textile industry. Derived from the indigo plant, this natural dye has been cherished for centuries, particularly in regions like India, where it has shaped cultural practices and industrial developments. In the contemporary global market, the export of indigo blue holds significant commercial value, intersecting with various economic considerations, including value-added tax (VAT) implications.

The market for indigo blue is buoyed by increasing demand for sustainable and organic products, reflecting a broader trend towards eco-conscious consumerism. As brands and consumers alike seek to reduce their environmental footprint, the demand for natural dyes, including indigo, is on the rise. This shift is not only beneficial for local economies reliant on traditional dyeing methods but also plays a role in preserving the heritage of indigo dyeing in countries such as India, which is home to some of the most skilled artisans in the world.

Exploring the Dynamics of Indigo Blue Exporting and VAT Implications

In many countries, indigo blue and other natural dyes may be subjected to different VAT rates depending on their classification—whether they are treated as raw materials, finished goods, or artisanal products. For instance, some jurisdictions may offer reduced VAT rates for organic products, incentivizing the export of sustainably sourced indigo. This can provide a competitive edge for exporters who prioritize organic farming practices and traditional dyeing techniques.

vat indigo blue exporter

However, exporters must also be vigilant in ensuring compliance with VAT regulations, which can vary significantly from one country to another. Accurate documentation, timely tax filings, and a clear understanding of the regulatory framework are crucial for avoiding penalties and ensuring smooth transactions. Furthermore, fluctuations in global trade policies and tariffs can impact the overall cost of exported indigo, complicating the export landscape.

On the importing side, buyers of indigo blue should also be aware of the VAT implications. Depending on the country of origin and the classification of the product, importers may be liable for VAT upon bringing indigo blue into their home market. This component can affect the pricing and ultimately influence purchasing decisions. Importers keen on maintaining cost-effectiveness must consider VAT in their sourcing strategies, potentially negotiating terms that account for these tax implications.

The interplay between indigo blue exporting and VAT is reflective of broader economic trends. As global markets become increasingly interconnected, the need for transparency and compliance in international trade is paramount. Many exporters are turning to digital solutions and platforms that facilitate better tracking of shipments, regulatory compliance, and efficient tax reporting. These innovations not only streamline operations but also ensure that exporters remain competitive in the dynamic landscape of international commerce.

In conclusion, the export of indigo blue is not merely a trade in color but an engagement with cultural heritage, sustainable practices, and economic strategy. Navigating the complexities of VAT is essential for maximizing the benefits of this vibrant market. As demand for natural dyes continues to grow, exporters who understand and adapt to the intricacies of VAT regulations will undoubtedly stand at the forefront of this colorful industry, paving the way for sustainable development and economic vitality.

-

Sulphur Black Dyes in Daily Use

NewsMay.07,2025

-

Indigo Dyeing for Daily Life

NewsMay.07,2025

-

Indigo Dye Production and Its Growing Demand

NewsMay.07,2025

-

Color That Lasts

NewsMay.07,2025

-

Bromo Indigo for Modern Use

NewsMay.07,2025

-

Blue From Nature

NewsMay.07,2025

-

The Timeless Color in Fashion and Textiles

NewsApr.10,2025

Sulphur Black

1.Name: sulphur black; Sulfur Black; Sulphur Black 1;

2.Structure formula:

3.Molecule formula: C6H4N2O5

4.CAS No.: 1326-82-5

5.HS code: 32041911

6.Product specification:Appearance:black phosphorus flakes; black liquid

Bromo Indigo; Vat Bromo-Indigo; C.I.Vat Blue 5

1.Name: Bromo indigo; Vat bromo-indigo; C.I.Vat blue 5;

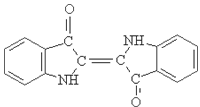

2.Structure formula:

3.Molecule formula: C16H6Br4N2O2

4.CAS No.: 2475-31-2

5.HS code: 3204151000 6.Major usage and instruction: Be mainly used to dye cotton fabrics.

Indigo Blue Vat Blue

1.Name: indigo blue,vat blue 1,

2.Structure formula:

3.Molecule formula: C16H10N2O2

4.. CAS No.: 482-89-3

5.Molecule weight: 262.62

6.HS code: 3204151000

7.Major usage and instruction: Be mainly used to dye cotton fabrics.