vat blue 1 companies

Understanding VAT Blue 1 Companies A Comprehensive Overview

Value Added Tax (VAT) is an essential component of modern tax systems, and its implementation varies by country. Among the different VAT categories, VAT Blue 1 Companies has emerged as a specific classification worth exploring. This designation refers primarily to entities that deal with goods or services subject to a particular VAT rate, often aimed at stimulating economic growth and supporting specific sectors.

What Are VAT Blue 1 Companies?

VAT Blue 1 Companies are typically businesses that provide essential goods and services considered critical for economic stability and community welfare. These companies might operate in sectors such as agriculture, health care, and education, where the government recognizes the need to support them through favorable tax rates. By labeling these companies as Blue, it not only signifies a lower tax burden but also a form of protection against market fluctuations.

The Importance of VAT in Business Operations

For businesses, VAT is more than just a tax; it is integrated into their pricing strategies, revenue models, and financial planning. VAT Blue 1 Companies benefit from reduced tax liabilities, allowing them to reinvest savings into their operations, improve service delivery, and support community initiatives. This favorable treatment can lead to a more competitive pricing strategy, which is essential in attracting customers and maintaining market share.

Implications of the VAT Blue 1 Designation

vat blue 1 companies

The implications of being classified as a VAT Blue 1 Company extend beyond tax relief. These companies often gain access to various government support programs, including grants or subsidies aimed at fostering innovation and growth. Being recognized in this manner can also enhance a company's reputation, signaling reliability and commitment to contributing positively to the economy.

In addition to financial benefits, VAT Blue 1 Companies may also face strict compliance requirements regarding record-keeping and reporting. Adhering to these regulations is crucial, as any discrepancies can lead to penalties or loss of classification. Therefore, businesses must invest in proper accounting systems and training for their staff to ensure they meet all relevant VAT obligations.

Challenges Facing VAT Blue 1 Companies

Despite the advantages, VAT Blue 1 Companies are not without challenges. Fluctuations in market demand, changes in government policy, and the economic climate can all impact their operations. For instance, if the government alters the criteria for VAT classification or changes rates, it could significantly affect a company's financial situation.

Additionally, while the tax benefits are enticing, companies must remain vigilant about their service quality and operational efficiency. As they grow, the complexities of managing both VAT compliance and business performance can increase, necessitating robust management strategies.

Conclusion

In conclusion, VAT Blue 1 Companies play a crucial role in the economy by providing essential goods and services while benefiting from favorable tax treatment. While they enjoy reduced tax burdens and potential government support, they also face challenges that require diligent management and compliance. Recognizing the value and responsibilities associated with this classification is essential for any business seeking to leverage its advantages effectively. By understanding the dynamics of VAT and its impact on operations, VAT Blue 1 Companies can navigate the complexities of the market and contribute meaningfully to economic growth.

-

The Timeless Art of Denim Indigo Dye

NewsJul.01,2025

-

The Rise of Sulfur Dyed Denim

NewsJul.01,2025

-

The Rich Revival of the Best Indigo Dye

NewsJul.01,2025

-

The Enduring Strength of Sulphur Black

NewsJul.01,2025

-

The Ancient Art of Chinese Indigo Dye

NewsJul.01,2025

-

Industry Power of Indigo

NewsJul.01,2025

-

Black Sulfur is Leading the Next Wave

NewsJul.01,2025

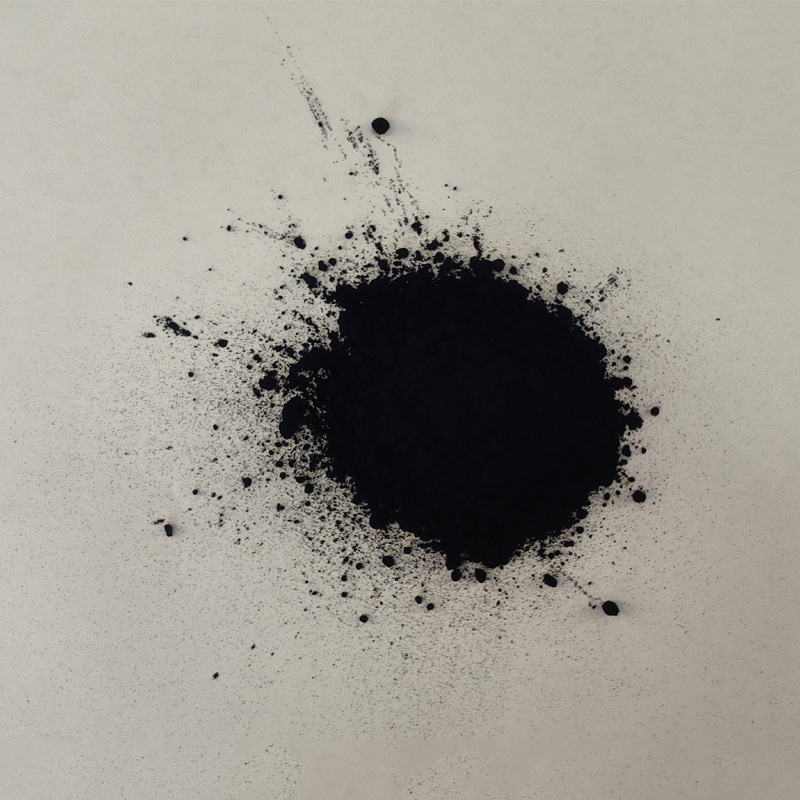

Sulphur Black

1.Name: sulphur black; Sulfur Black; Sulphur Black 1;

2.Structure formula:

3.Molecule formula: C6H4N2O5

4.CAS No.: 1326-82-5

5.HS code: 32041911

6.Product specification:Appearance:black phosphorus flakes; black liquid

Bromo Indigo; Vat Bromo-Indigo; C.I.Vat Blue 5

1.Name: Bromo indigo; Vat bromo-indigo; C.I.Vat blue 5;

2.Structure formula:

3.Molecule formula: C16H6Br4N2O2

4.CAS No.: 2475-31-2

5.HS code: 3204151000 6.Major usage and instruction: Be mainly used to dye cotton fabrics.

Indigo Blue Vat Blue

1.Name: indigo blue,vat blue 1,

2.Structure formula:

3.Molecule formula: C16H10N2O2

4.. CAS No.: 482-89-3

5.Molecule weight: 262.62

6.HS code: 3204151000

7.Major usage and instruction: Be mainly used to dye cotton fabrics.