vat indigo manufacturer

The Impact of VAT on Indigo Manufacturers

In recent years, the indigo dyeing industry has garnered significant attention due to its historical significance and sustainability concerns. Indigo, a natural dye derived from plants, has been used for centuries to color textiles, making it a vital part of cultural heritage in many regions. However, the imposition of Value Added Tax (VAT) on indigo manufacturers raises questions regarding its implications on the industry, pricing, and sustainability efforts.

The application of VAT on indigo manufacturing can be seen as a double-edged sword. On one hand, it generates revenue for governments, which can be channeled into public services and infrastructure development. This is particularly crucial for developing countries where such industries are prominent. However, for indigo manufacturers, especially smallholders and artisanal producers, VAT can impose a significant financial burden.

The Impact of VAT on Indigo Manufacturers

One of the significant challenges faced by indigo manufacturers is the compliance with VAT regulations. Many small-scale producers lack the resources and knowledge to navigate the complexities of tax systems. This can lead to unintentional non-compliance, resulting in fines and other penalties. Additionally, larger manufacturers may have more robust mechanisms to manage VAT and could potentially monopolize the market, pushing smaller players out.

vat indigo manufacturer

Despite these challenges, the VAT system could be adapted to support the indigo industry better. For example, tax rebates could be offered to manufacturers who adhere to sustainable practices, thus incentivizing environmentally friendly production methods. This approach would not only alleviate some of the financial burdens but would also encourage more manufacturers to adopt sustainable practices, aligning the industry's goals with global sustainability efforts.

Moreover, educating indigo manufacturers about VAT and providing them with the necessary tools and resources to comply with regulations is crucial. Workshops and government support initiatives can empower producers, ensuring they remain competitive while adhering to tax laws. By simplifying VAT registration processes and offering guidance, governments can create an environment where natural dye producers can thrive.

The role of consumers in this equation is also significant. There is a growing movement towards ethical consumption, where buyers are willing to pay a premium for sustainably sourced products. If consumers can be educated about the benefits of natural indigo and the artistry behind its production — including the social and environmental implications — they may be more inclined to support these manufacturers, even if prices rise due to VAT.

In conclusion, the impact of VAT on indigo manufacturers is multifaceted. While it poses challenges related to cost, compliance, and market competition, with thoughtful reforms and support, it can also be a catalyst for sustainable practices in the industry. By fostering a partnership between governments, manufacturers, and consumers, the indigo dyeing industry can not only survive the pressures of taxation but also thrive, preserving a vital cultural legacy for future generations. The focus should shift towards creating a resilient ecosystem that benefits all stakeholders while promoting sustainability in the indigo manufacturing process.

-

The Timeless Art of Denim Indigo Dye

NewsJul.01,2025

-

The Rise of Sulfur Dyed Denim

NewsJul.01,2025

-

The Rich Revival of the Best Indigo Dye

NewsJul.01,2025

-

The Enduring Strength of Sulphur Black

NewsJul.01,2025

-

The Ancient Art of Chinese Indigo Dye

NewsJul.01,2025

-

Industry Power of Indigo

NewsJul.01,2025

-

Black Sulfur is Leading the Next Wave

NewsJul.01,2025

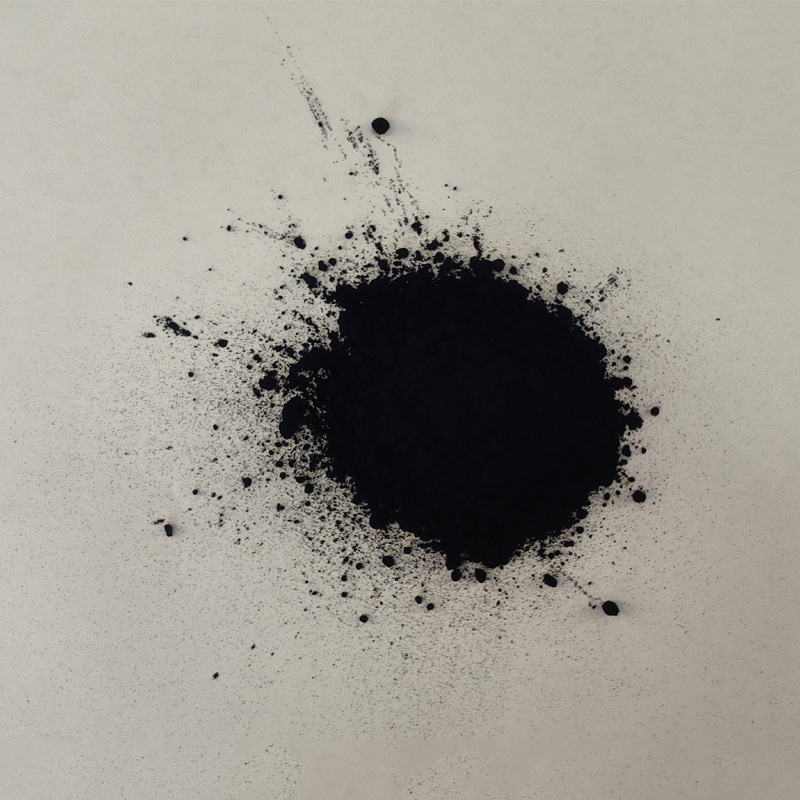

Sulphur Black

1.Name: sulphur black; Sulfur Black; Sulphur Black 1;

2.Structure formula:

3.Molecule formula: C6H4N2O5

4.CAS No.: 1326-82-5

5.HS code: 32041911

6.Product specification:Appearance:black phosphorus flakes; black liquid

Bromo Indigo; Vat Bromo-Indigo; C.I.Vat Blue 5

1.Name: Bromo indigo; Vat bromo-indigo; C.I.Vat blue 5;

2.Structure formula:

3.Molecule formula: C16H6Br4N2O2

4.CAS No.: 2475-31-2

5.HS code: 3204151000 6.Major usage and instruction: Be mainly used to dye cotton fabrics.

Indigo Blue Vat Blue

1.Name: indigo blue,vat blue 1,

2.Structure formula:

3.Molecule formula: C16H10N2O2

4.. CAS No.: 482-89-3

5.Molecule weight: 262.62

6.HS code: 3204151000

7.Major usage and instruction: Be mainly used to dye cotton fabrics.