Wholesale Indigo Vat Dye for Textile and Fashion Industries

The Role of Wholesale VAT in the Indigo Dye Industry

Indigo, a deep blue dye derived from the leaves of the indigofera plant, has been used for centuries to dye textiles, particularly in the denim industry. As the demand for indigo-dyed products continues to grow, understanding the nuances of wholesale pricing, particularly with regards to value-added tax (VAT), becomes increasingly important for manufacturers, distributors, and retailers alike.

Understanding Wholesale Pricing and VAT

Wholesale pricing typically refers to the selling of goods in large quantities at lower prices, intended for resale by retailers. When it comes to indigo dyes, the wholesale market functions within a complex framework of supply chains, regulations, and tax implications. In many countries, the sale of goods, including textile dyes, is subject to VAT—an indirect tax imposed at each stage of production and distribution.

For wholesale suppliers dealing in indigo dye, it is essential to comprehend how VAT affects pricing and profitability. Typically, VAT is added to the wholesale price of the dye sold to retailers, who themselves may need to charge VAT when selling to end consumers. This means that understanding the correct VAT rate applicable to indigo dye can significantly influence pricing strategies and overall market competitiveness.

Impact on the Indigo Dye Industry

1. Cost Structure The inclusion of VAT in the pricing of indigo dyes can impact the overall cost structure for manufacturers and retailers. Understanding whether a particular transaction is subject to zero-rate or reduced-rate VAT can help businesses in accurately calculating costs and pricing for end consumers.

wholesale vat dye indigo

2. Competitive Edge For wholesalers, being knowledgeable about VAT regulations allows them to price their products competitively. This is particularly vital in the textile industry, where margins can be thin, and price differentiation is crucial for securing contracts with major retailers.

3. Financial Planning Properly accounting for VAT is not only a matter of compliance but also plays a critical role in financial planning. Wholesalers must ensure that they manage cash flows effectively to accommodate VAT payments and claims. Many businesses might be eligible to reclaim VAT on their purchases. Understanding this aspect can enhance profitability and liquidity.

4. Market Trends The demand for sustainable and eco-friendly dyes, including indigo, has been on the rise. The wholesale market must adapt to these trends while being mindful of VAT regulations. As consumers become more conscious about sustainability, businesses that can convey their compliance with VAT and sustainable practices are likely to perform better in today’s market.

5. Export Implications The international trade of indigo dye often comes with additional VAT considerations. When exporting, the VAT treatment can vary greatly depending on the country of origin and destination. Wholesalers must have a firm grasp of international VAT laws to avoid pitfalls that could lead to financial losses or legal complications.

Conclusion

In conclusion, wholesale VAT is a critical factor in the indigo dye industry that businesses must navigate to remain competitive and profitable. By understanding the implications of VAT on their pricing models, wholesalers can set more accurate prices, manage financial risks, and adapt to market changes. As sustainability becomes a driving force in consumer choices, those in the indigo dye industry that embrace compliance and transparent pricing structures will likely thrive in an increasingly complex market landscape. The interplay of VAT regulations and wholesale dynamics shapes the future of textile dyeing industries, making it essential for stakeholders to stay informed and agile.

-

Sulphur Black Dyes in Daily Use

NewsMay.07,2025

-

Indigo Dyeing for Daily Life

NewsMay.07,2025

-

Indigo Dye Production and Its Growing Demand

NewsMay.07,2025

-

Color That Lasts

NewsMay.07,2025

-

Bromo Indigo for Modern Use

NewsMay.07,2025

-

Blue From Nature

NewsMay.07,2025

-

The Timeless Color in Fashion and Textiles

NewsApr.10,2025

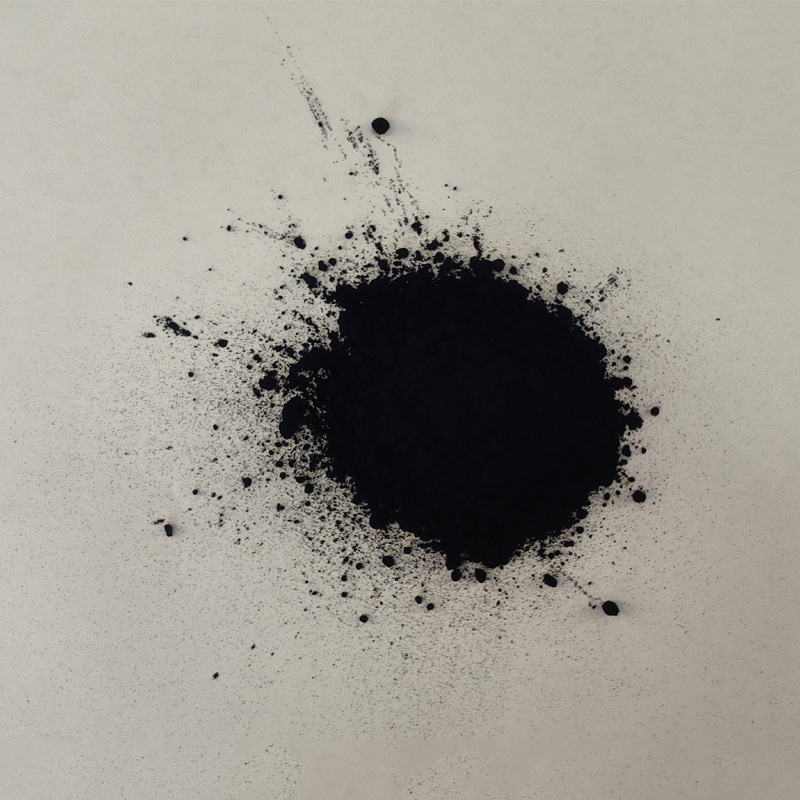

Sulphur Black

1.Name: sulphur black; Sulfur Black; Sulphur Black 1;

2.Structure formula:

3.Molecule formula: C6H4N2O5

4.CAS No.: 1326-82-5

5.HS code: 32041911

6.Product specification:Appearance:black phosphorus flakes; black liquid

Bromo Indigo; Vat Bromo-Indigo; C.I.Vat Blue 5

1.Name: Bromo indigo; Vat bromo-indigo; C.I.Vat blue 5;

2.Structure formula:

3.Molecule formula: C16H6Br4N2O2

4.CAS No.: 2475-31-2

5.HS code: 3204151000 6.Major usage and instruction: Be mainly used to dye cotton fabrics.

Indigo Blue Vat Blue

1.Name: indigo blue,vat blue 1,

2.Structure formula:

3.Molecule formula: C16H10N2O2

4.. CAS No.: 482-89-3

5.Molecule weight: 262.62

6.HS code: 3204151000

7.Major usage and instruction: Be mainly used to dye cotton fabrics.