Exploring VAT Trends and Practices Among Indigo Companies in Various Sectors

The Role of VAT in Indigo Companies

Value Added Tax (VAT) plays an essential role in the operations of businesses around the world, including those in the indigo sector. The indigo industry, known for its rich blue dye, has a long history that intertwines with cultural and economic developments across regions. In current times, companies involved in the production and distribution of indigo dyes face the challenge of navigating VAT regulations, which can significantly impact their profitability and operational efficiency.

The Role of VAT in Indigo Companies

In many countries, VAT is implemented as a multi-stage tax, applied at each step of the supply chain. For indigo companies, this means that they must consider VAT when purchasing raw materials, processing them into dye, and selling their final products. For instance, when an indigo manufacturer buys the plants from farmers, they pay VAT on that purchase. Similarly, when they sell the dyed textiles to retailers, they must charge VAT on the sale price, passing this tax on to the final consumer.

vat indigo companies

One of the challenges faced by indigo companies is the variability of VAT rates across different jurisdictions. While some countries may offer reduced rates for eco-friendly goods or artisan products, others may impose standard rates that can significantly affect pricing strategies. Companies must remain compliant with local VAT laws, making it essential to stay updated on any changes to tax regulations. Non-compliance can lead to hefty fines, undermining the financial health of these businesses.

Moreover, the nature of the indigo market often means that companies operate on tight margins. Thus, effective VAT management becomes even more critical. Smart indigo companies leverage sophisticated accounting systems to track VAT payments and credits, ensuring that they maximize their allowable deductions. This can help mitigate the impacts of VAT on their overall cash flow.

The increasing globalization of the indigo market adds another layer of complexity. Companies now export their products to various countries, each with its own VAT regulations. This necessitates a thorough understanding of international tax laws to avoid double taxation and ensure compliance in foreign markets. Likewise, the advent of e-commerce has made it easier for indigo products to reach international consumers, placing additional demands on businesses to manage VAT for cross-border sales effectively.

In conclusion, VAT represents a significant consideration for companies within the indigo sector. Whether they are producers, manufacturers, or retailers, understanding and managing VAT obligations is essential for maintaining profitability and ensuring compliance. As the indigo market continues to evolve, businesses must remain vigilant, adopting best practices in VAT management to navigate the complexities of this indispensable tax. As they grapple with these challenges, the continued appreciation for indigo’s unique properties and cultural significance will undoubtedly sustain demand for this vibrant dye, contributing to the resilience and adaptability of indigo companies in the market.

-

The Timeless Art of Denim Indigo Dye

NewsJul.01,2025

-

The Rise of Sulfur Dyed Denim

NewsJul.01,2025

-

The Rich Revival of the Best Indigo Dye

NewsJul.01,2025

-

The Enduring Strength of Sulphur Black

NewsJul.01,2025

-

The Ancient Art of Chinese Indigo Dye

NewsJul.01,2025

-

Industry Power of Indigo

NewsJul.01,2025

-

Black Sulfur is Leading the Next Wave

NewsJul.01,2025

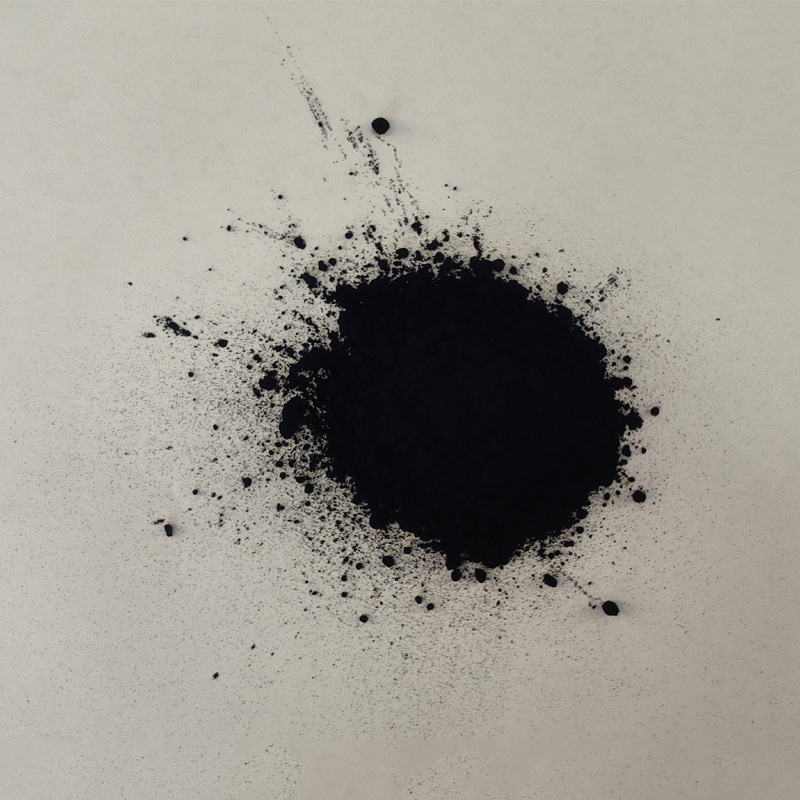

Sulphur Black

1.Name: sulphur black; Sulfur Black; Sulphur Black 1;

2.Structure formula:

3.Molecule formula: C6H4N2O5

4.CAS No.: 1326-82-5

5.HS code: 32041911

6.Product specification:Appearance:black phosphorus flakes; black liquid

Bromo Indigo; Vat Bromo-Indigo; C.I.Vat Blue 5

1.Name: Bromo indigo; Vat bromo-indigo; C.I.Vat blue 5;

2.Structure formula:

3.Molecule formula: C16H6Br4N2O2

4.CAS No.: 2475-31-2

5.HS code: 3204151000 6.Major usage and instruction: Be mainly used to dye cotton fabrics.

Indigo Blue Vat Blue

1.Name: indigo blue,vat blue 1,

2.Structure formula:

3.Molecule formula: C16H10N2O2

4.. CAS No.: 482-89-3

5.Molecule weight: 262.62

6.HS code: 3204151000

7.Major usage and instruction: Be mainly used to dye cotton fabrics.