oem vat indigo

Understanding OEM VAT in the Context of Indigo A Comprehensive Overview

In today's globalized marketplace, businesses increasingly rely on Original Equipment Manufacturers (OEMs) to produce goods under their brand names. These partnerships are pivotal for cost efficiency and scalability, especially in sectors like textiles, electronics, and automotive. However, one crucial aspect that often complicates these arrangements is VAT, or Value Added Tax, which can significantly impact pricing structures, profitability, and compliance obligations.

What is OEM?

OEM stands for Original Equipment Manufacturer. These companies produce products or components that are then rebranded and sold by another company. For instance, an electronics firm may partner with an OEM to create a line of gadgets that carry its name, relying on the OEM's expertise to ensure quality and efficiency in manufacturing.

The Role of VAT in OEM Transactions

VAT is a consumption tax placed on goods and services at each stage of production or distribution. In the context of OEM relationships, the complexity of VAT arises from the international nature of many such transactions. When an OEM operates in a different country than the brand owner, various regulations concerning VAT can come into play.

For instance, when goods are manufactured in one country and sold in another, the VAT rates applicable may differ significantly. This divergence can lead to higher costs for brands if they do not manage VAT effectively. In many cases, businesses may benefit from tax exemptions or reduced rates depending on the nature of the goods and the specific agreements in place.

The Indigo Example

Indigo, known for its vibrant and sustainable textiles, offers an interesting case study regarding OEM and VAT. When sourcing fabrics from OEMs, Indigo must navigate various VAT regulations that differ from country to country. The brand's commitment to sustainability adds another layer of complexity, as it often aligns with local laws aimed at reducing environmental impact.

oem vat indigo

For example, if Indigo sources organic cotton from an OEM in India, complying with both Indian VAT laws and the VAT implications of importing goods into their target market is paramount. This includes understanding the tax implications of the import process, potential refunds on exported goods, and ensuring that all invoices comply with VAT regulations.

Strategies for Managing OEM VAT

To effectively manage VAT in OEM transactions, businesses can adopt several strategies

1. Consultation with Tax Experts Engaging with tax consultants who specialize in international business can provide valuable insights into minimizing VAT liabilities and maximizing compliance.

2. Understanding Local Regulations Each country has its VAT laws, and it is crucial to understand these thoroughly. This knowledge allows businesses to utilize available exemptions or reduced rates where applicable.

3. Automation of Processes Implementing software solutions that automate VAT calculations and keep track of invoices can reduce human error and ensure compliance.

4. Training and Awareness Regular training sessions for finance teams about VAT regulations can foster a culture of compliance and awareness within organizations.

Conclusion

The intersection of OEM relationships and VAT management presents both challenges and opportunities for brands like Indigo. As businesses continue to navigate the complexities of global trade, understanding VAT implications will be essential for maximizing profitability and ensuring compliance. By adopting proactive strategies, companies can effectively manage VAT responsibilities, allowing them to focus on innovation and quality in their products. In the ever-competitive landscape, where sustainability and efficiency are vital, mastering the intricacies of OEM VAT is more crucial than ever for success.

-

The Timeless Art of Denim Indigo Dye

NewsJul.01,2025

-

The Rise of Sulfur Dyed Denim

NewsJul.01,2025

-

The Rich Revival of the Best Indigo Dye

NewsJul.01,2025

-

The Enduring Strength of Sulphur Black

NewsJul.01,2025

-

The Ancient Art of Chinese Indigo Dye

NewsJul.01,2025

-

Industry Power of Indigo

NewsJul.01,2025

-

Black Sulfur is Leading the Next Wave

NewsJul.01,2025

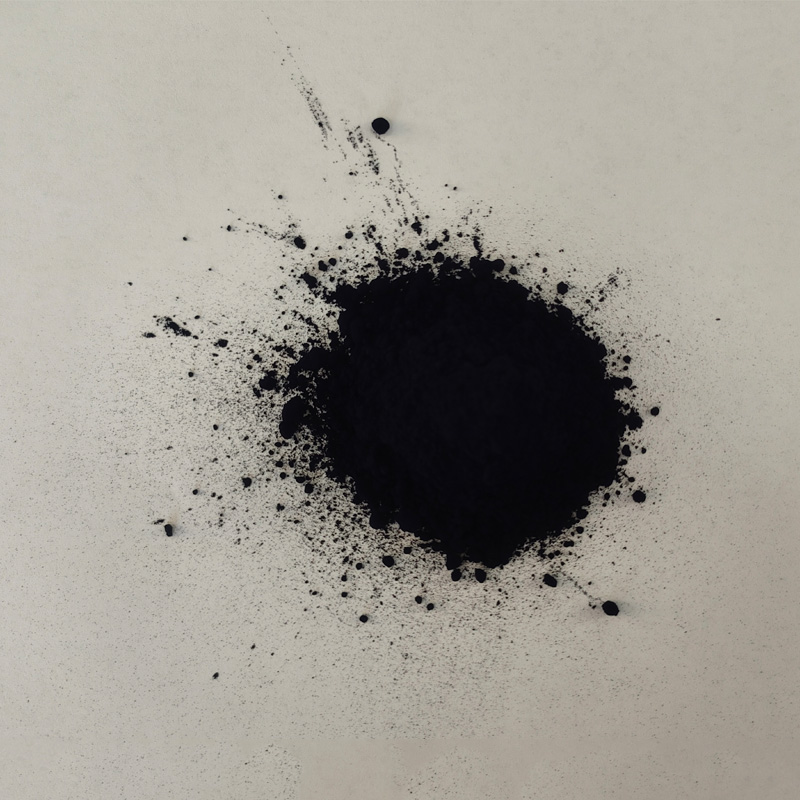

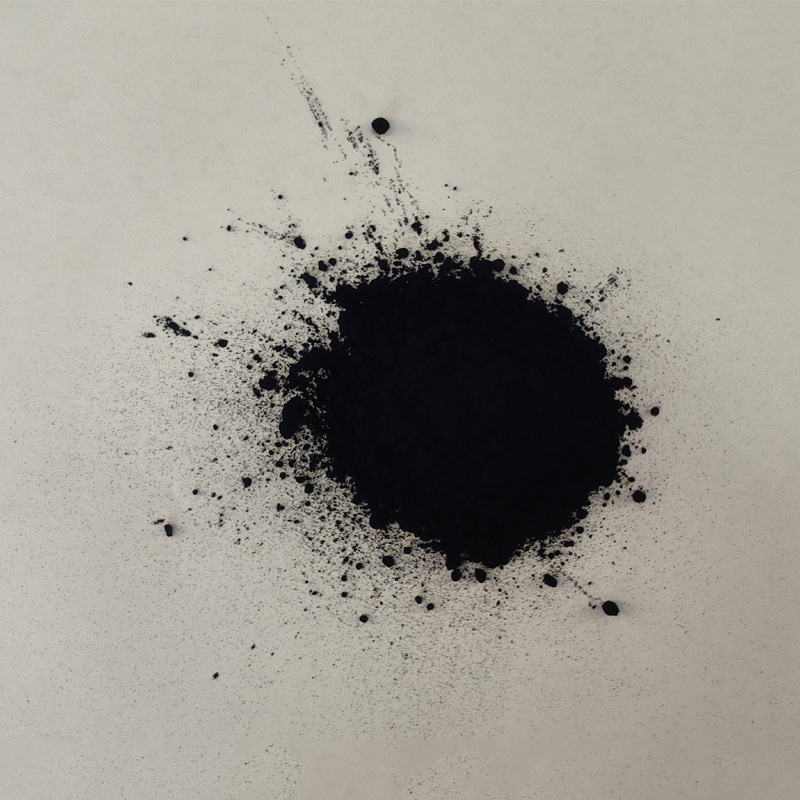

Sulphur Black

1.Name: sulphur black; Sulfur Black; Sulphur Black 1;

2.Structure formula:

3.Molecule formula: C6H4N2O5

4.CAS No.: 1326-82-5

5.HS code: 32041911

6.Product specification:Appearance:black phosphorus flakes; black liquid

Bromo Indigo; Vat Bromo-Indigo; C.I.Vat Blue 5

1.Name: Bromo indigo; Vat bromo-indigo; C.I.Vat blue 5;

2.Structure formula:

3.Molecule formula: C16H6Br4N2O2

4.CAS No.: 2475-31-2

5.HS code: 3204151000 6.Major usage and instruction: Be mainly used to dye cotton fabrics.

Indigo Blue Vat Blue

1.Name: indigo blue,vat blue 1,

2.Structure formula:

3.Molecule formula: C16H10N2O2

4.. CAS No.: 482-89-3

5.Molecule weight: 262.62

6.HS code: 3204151000

7.Major usage and instruction: Be mainly used to dye cotton fabrics.