discount vat blue 1

Understanding Discount, VAT, and the Blue Economy A Comprehensive Overview

In today's global economy, the concepts of discounting, value-added tax (VAT), and sustainable practices are fundamental for both businesses and consumers. This article aims to unpack these financial mechanisms while exploring the role of the blue economy in promoting sustainable practices in commerce.

Discounts An Incentive for Consumers

Discounts have long been a tactic employed by retailers and service providers to attract consumers, increase sales, and maintain competitive advantage. A discount, in simple terms, is a reduction in the price of goods or services, often used during sales events, festive seasons, or as a promotional strategy. When an item is marked down, it allows consumers to purchase products at a lower price, incentivizing spending.

While discounts are beneficial for consumers, they can also pose challenges for businesses. Offering discounts can lead to decreased profit margins. Businesses must carefully strategize their discount offerings to ensure they do not undermine their profitability. However, when implemented wisely, discounts can significantly boost customer loyalty and enhance brand recognition.

Understanding VAT The Value-Added Tax

Value-added tax (VAT) is a consumption tax placed on a product whenever value is added at each stage of production and distribution, from the initial manufacturing to the final sale. VAT is commonly used in many countries around the world, and it represents a significant source of revenue for governments.

The workings of VAT can be complex, but its primary principle is straightforward. When manufacturers and retailers add value to products, they charge VAT on the sale price. Therefore, when consumers purchase products, they pay the original price plus VAT. This tax method is generally considered more efficient than traditional sales tax systems because it allows for a cumulative tax on value added at each stage, rather than just at the final sale.

The Blue Economy Sustainability and Innovation

The term blue economy refers to the sustainable use of ocean resources for economic growth, improved livelihoods, and jobs while preserving the health of ocean ecosystems. Emphasizing sustainability, the blue economy intertwines economic development with environmental stewardship.

discount vat blue 1

As the impacts of climate change and pollution become increasingly apparent, the blue economy presents an opportunity to harness ocean resources without depleting them. Sustainable fishing practices, marine tourism, and renewable energy production are essential components of this economic model. Furthermore, enterprises focusing on the blue economy can benefit from governmental incentives, including tax breaks and discounts for eco-friendly practices.

Bridging Discounts and VAT in the Blue Economy

Integrating the concepts of discounts and VAT within the framework of the blue economy is crucial for fostering sustainable business practices. When companies in marine industries offer discounts on sustainable products or services, they not only attract environmentally-conscious consumers but may also enhance their market share.

For instance, a fishing company that adopts sustainable practices might offer discounts on products caught using eco-friendly methods, while consumers benefit from lower prices. Simultaneously, if VAT incentives exist for environmentally sustainable products, it encourages businesses to adopt these practices, thereby reinforcing the cycle of sustainability.

The Future A Harmonized Approach

As we look to the future, a harmonized approach to managing discounts, VAT, and the blue economy is imperative. Policymakers should consider implementing frameworks that support businesses embracing sustainable practices while ensuring that the tax mechanisms encourage such behavior.

Educational programs can also play a role in raising consumer awareness about the importance of supporting sustainable businesses, demonstrating how discounts and VAT can affect their purchasing choices and, ultimately, the health of the oceans.

Conclusion

In conclusion, the relationship between discounts, VAT, and the blue economy highlights a crucial intersection of economic and environmental considerations. As consumers become more aware of the importance of sustainability, businesses that adopt eco-friendly practices and communicate these efforts effectively will likely stand out in an increasingly crowded market. By understanding and leveraging the dynamics of discounts and VAT in the context of the blue economy, stakeholders can contribute to a more sustainable and prosperous future for all.

-

The Timeless Art of Denim Indigo Dye

NewsJul.01,2025

-

The Rise of Sulfur Dyed Denim

NewsJul.01,2025

-

The Rich Revival of the Best Indigo Dye

NewsJul.01,2025

-

The Enduring Strength of Sulphur Black

NewsJul.01,2025

-

The Ancient Art of Chinese Indigo Dye

NewsJul.01,2025

-

Industry Power of Indigo

NewsJul.01,2025

-

Black Sulfur is Leading the Next Wave

NewsJul.01,2025

Sulphur Black

1.Name: sulphur black; Sulfur Black; Sulphur Black 1;

2.Structure formula:

3.Molecule formula: C6H4N2O5

4.CAS No.: 1326-82-5

5.HS code: 32041911

6.Product specification:Appearance:black phosphorus flakes; black liquid

Bromo Indigo; Vat Bromo-Indigo; C.I.Vat Blue 5

1.Name: Bromo indigo; Vat bromo-indigo; C.I.Vat blue 5;

2.Structure formula:

3.Molecule formula: C16H6Br4N2O2

4.CAS No.: 2475-31-2

5.HS code: 3204151000 6.Major usage and instruction: Be mainly used to dye cotton fabrics.

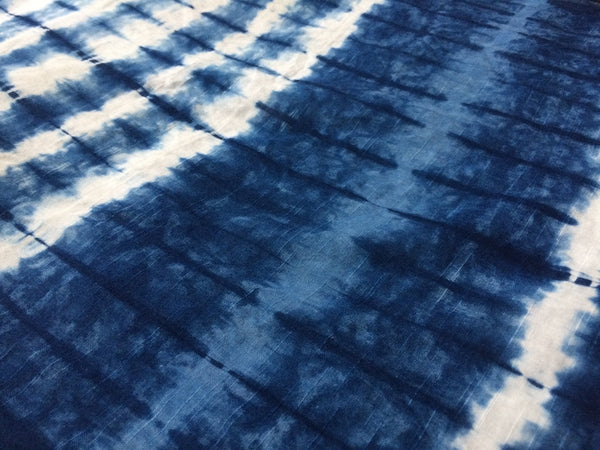

Indigo Blue Vat Blue

1.Name: indigo blue,vat blue 1,

2.Structure formula:

3.Molecule formula: C16H10N2O2

4.. CAS No.: 482-89-3

5.Molecule weight: 262.62

6.HS code: 3204151000

7.Major usage and instruction: Be mainly used to dye cotton fabrics.