buy vat blue 1

The Importance of Understanding VAT in E-Commerce A Focus on Buy VAT Blue 1

In the ever-evolving landscape of e-commerce, the implications of Value Added Tax (VAT) have become increasingly significant for both consumers and businesses alike. One particular case that highlights the complexity of VAT regulations is Buy VAT Blue 1. This topic encompasses various dimensions of how VAT is applied, its consequences for purchasing behaviors, and the broader implications for online commerce.

Understanding VAT

Value Added Tax is a consumption tax levied on the value added to goods and services at each stage of production or distribution. It is typically charged as a percentage of the sale price, and consumers ultimately bear the cost. For e-commerce businesses, navigating VAT regulations can be complex, particularly when selling to international customers. Each country has its own VAT rate and rules regarding collection and remittance, and this variability can lead to confusion for both sellers and buyers.

In e-commerce transactions, particularly with platforms that allow for global sales, understanding how VAT applies to sales is crucial. Buy VAT Blue 1 serves as a reference point for how certain products may be affected by VAT rules, especially within regions with specific taxation policies.

The Implications of VAT on E-Commerce Purchases

Purchasing decisions are often influenced by the total cost of the product, which includes VAT. For instance, if a consumer is considering buying VAT Blue 1, the final price they pay would incorporate any applicable VAT. This means that businesses need to be transparent about pricing to build trust and maintain consumer satisfaction.

Furthermore, consumers are becoming more VAT-savvy. They are increasingly aware of how tax affects their overall spending and may compare prices across platforms, taking VAT into account when making decisions. This trend compels e-commerce platforms to ensure they are compliant with VAT regulations, as failure to do so can lead to significant penalties and loss of customer trust.

buy vat blue 1

Cross-Border Transactions and VAT Challenges

One of the most daunting aspects of e-commerce for both businesses and consumers is dealing with cross-border transactions. When purchasing Buy VAT Blue 1 from a seller located in another country, consumers may not be familiar with how VAT will apply. In many cases, they may end up paying unexpected fees or taxes upon delivery, which can lead to frustration and dissatisfaction.

Businesses engaged in international sales must understand the VAT implications of selling to consumers in different jurisdictions. This means having a firm grasp of rules like the EU's One-Stop-Shop (OSS) system, which simplifies VAT compliance for businesses selling to consumers across member states. Collecting VAT at the point of sale is crucial to streamline the process and avoid surprising turnarounds for customers.

The Role of Technology in Managing VAT

As e-commerce continues to integrate with more sophisticated technologies, businesses are turning to software solutions to help manage VAT compliance. Automated systems can calculate applicable taxes based on the characteristics of the product and the location of the buyer, ensuring that consumers are charged the correct amount. For products like Buy VAT Blue 1, where uncertainty about VAT rates may arise, these technologies can alleviate potential challenges by offering clarity and accuracy.

Additionally, e-commerce platforms are increasingly implementing educational resources that help consumers understand VAT. Transparent communication regarding VAT will likely enhance consumer trust and potentially lead to increased sales, as buyers feel more informed and secure when making a purchase.

Conclusion

In conclusion, the topic of Buy VAT Blue 1 serves as a microcosm of the larger dialogue surrounding VAT in e-commerce. Understanding the intricacies of VAT is paramount for consumers and businesses to thrive in an online market that spans the globe. As regulations become more complex and consumer expectations evolve, businesses must remain vigilant and adaptable. By embracing technology and prioritizing transparency, e-commerce players can navigate the VAT landscape effectively, ensuring a smooth and positive experience for all. This is not just about compliance; it is about enabling informed purchasing decisions that contribute to the dynamic nature of e-commerce itself.

-

The Timeless Art of Denim Indigo Dye

NewsJul.01,2025

-

The Rise of Sulfur Dyed Denim

NewsJul.01,2025

-

The Rich Revival of the Best Indigo Dye

NewsJul.01,2025

-

The Enduring Strength of Sulphur Black

NewsJul.01,2025

-

The Ancient Art of Chinese Indigo Dye

NewsJul.01,2025

-

Industry Power of Indigo

NewsJul.01,2025

-

Black Sulfur is Leading the Next Wave

NewsJul.01,2025

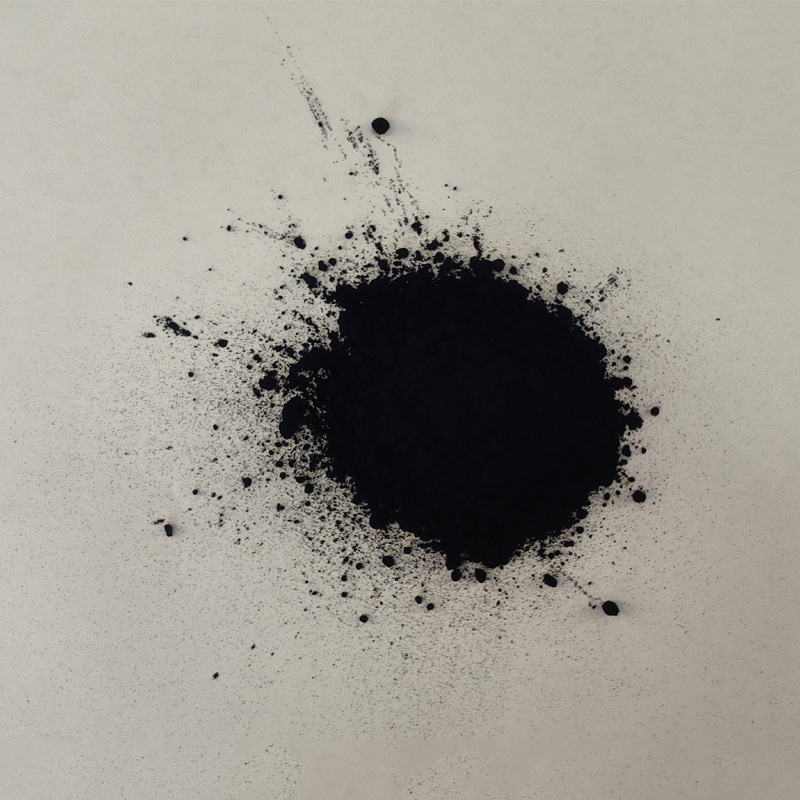

Sulphur Black

1.Name: sulphur black; Sulfur Black; Sulphur Black 1;

2.Structure formula:

3.Molecule formula: C6H4N2O5

4.CAS No.: 1326-82-5

5.HS code: 32041911

6.Product specification:Appearance:black phosphorus flakes; black liquid

Bromo Indigo; Vat Bromo-Indigo; C.I.Vat Blue 5

1.Name: Bromo indigo; Vat bromo-indigo; C.I.Vat blue 5;

2.Structure formula:

3.Molecule formula: C16H6Br4N2O2

4.CAS No.: 2475-31-2

5.HS code: 3204151000 6.Major usage and instruction: Be mainly used to dye cotton fabrics.

Indigo Blue Vat Blue

1.Name: indigo blue,vat blue 1,

2.Structure formula:

3.Molecule formula: C16H10N2O2

4.. CAS No.: 482-89-3

5.Molecule weight: 262.62

6.HS code: 3204151000

7.Major usage and instruction: Be mainly used to dye cotton fabrics.