Exploring VAT Strategies for Indigo Company and Its Impact on Business Growth

The Impact of VAT on Indigo Company A Comprehensive Overview

Value Added Tax (VAT) is a critical component of the tax structure in many countries, designed to collect revenue at each stage of production and distribution. For Indigo Company, VAT operates both as a financial obligation and a strategic consideration that influences its pricing, operations, and overall competitiveness in the market.

Indigo Company, known for its innovative products and sustainable practices, primarily operates in the textile and fashion industry. The incorporation of VAT into its pricing strategy is essential for maintaining compliance with government regulations while balancing customer expectations. In many regions where Indigo operates, VAT rates can significantly affect the final prices of goods, thereby influencing consumer purchasing decisions and the company’s sales volume.

Understanding VAT Structure

In a general sense, VAT is charged at each stage of the supply chain, from production to sale. For Indigo, this means that when it procures raw materials, it pays VAT to suppliers, which can be reclaimed when products are sold. The final consumers bear the VAT burden, which is typically included in the retail price. Understanding this structure is vital for Indigo to optimize its pricing strategy and cash flow management.

The VAT rates vary by country, and in some cases, by product category. This variability requires that Indigo Company remains vigilant about the tax regulations in each market it engages. For example, while some countries may have a lower VAT rate for eco-friendly products, others might not offer such benefits. Consequently, Indigo must adapt its product offerings and marketing strategies according to the local VAT regime to enhance its competitiveness and appeal to socially conscious consumers.

Strategic Implications of VAT

vat indigo company

The implications of VAT on Indigo Company extend beyond mere compliance. First and foremost, VAT influences pricing strategies. Indigo needs to ensure that its pricing model reflects not only production costs and desired profit margins but also the VAT applicable in each market. This can become complicated, especially when variations in rates and tax exemptions apply.

Furthermore, VAT can impact cash flow. Indigo must effectively manage its VAT returns to optimize its financial situation. Efficient management of the VAT process involves diligent record-keeping and timely filings to reclaim VAT on inputs while ensuring that customers pay the correct VAT on products sold. Any delays or errors in VAT submission could result in penalties, affecting the company’s financial health and reputation.

Consumer Perception and Marketing

The way VAT is communicated to consumers also plays a significant role in marketing strategies. Pricing inclusive of VAT can sometimes obscure the perceived value of a product. For Indigo, which prides itself on transparency and sustainable practices, it is crucial to communicate how VAT aligns with the company’s ethos. By educating consumers about VAT’s role in supporting public services and environmental initiatives, Indigo can foster a positive brand image while justifying higher prices that might be driven by tax implications.

Moreover, the rise of e-commerce has introduced new challenges regarding VAT, particularly with cross-border sales. Indigo must navigate different VAT laws in various jurisdictions and ensure that it complies with international regulations. Failure to do so could lead to costly penalties and harm the brand's reputation.

Conclusion

In conclusion, VAT is a significant aspect of financial management for Indigo Company that extends beyond regulatory compliance. Its impact on pricing strategies, cash flow management, and consumer perception is profound. As the company continues to expand its reach in the competitive textile and fashion industry, embracing the complexities of VAT will be key to sustaining its growth and commitment to ethical practices. By effectively managing VAT, Indigo can not only meet its financial obligations but also enhance its brand’s value in the eyes of its customers, thus paving the way for future success.

-

The Timeless Art of Denim Indigo Dye

NewsJul.01,2025

-

The Rise of Sulfur Dyed Denim

NewsJul.01,2025

-

The Rich Revival of the Best Indigo Dye

NewsJul.01,2025

-

The Enduring Strength of Sulphur Black

NewsJul.01,2025

-

The Ancient Art of Chinese Indigo Dye

NewsJul.01,2025

-

Industry Power of Indigo

NewsJul.01,2025

-

Black Sulfur is Leading the Next Wave

NewsJul.01,2025

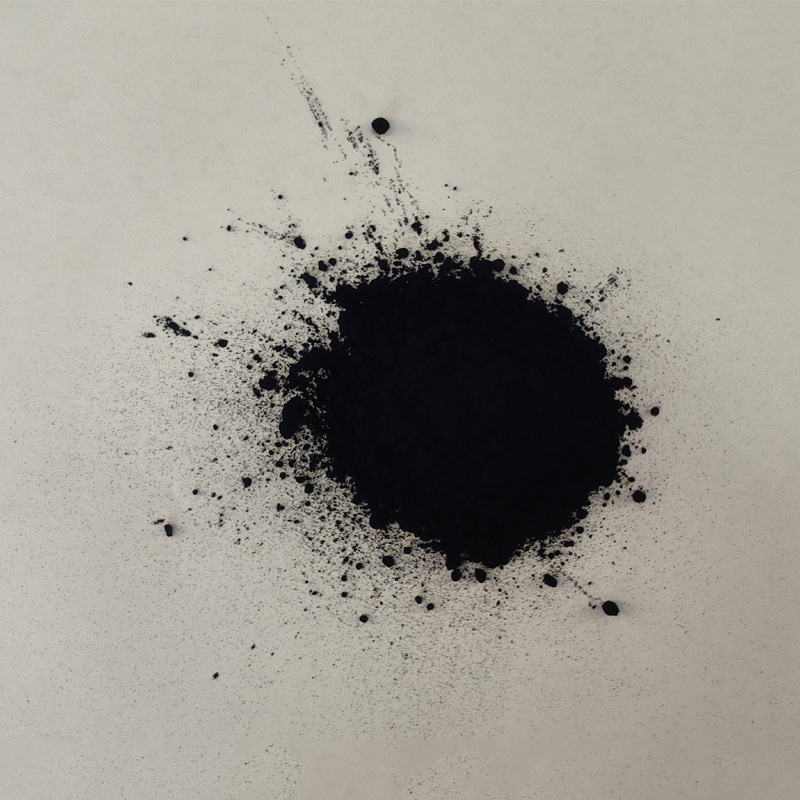

Sulphur Black

1.Name: sulphur black; Sulfur Black; Sulphur Black 1;

2.Structure formula:

3.Molecule formula: C6H4N2O5

4.CAS No.: 1326-82-5

5.HS code: 32041911

6.Product specification:Appearance:black phosphorus flakes; black liquid

Bromo Indigo; Vat Bromo-Indigo; C.I.Vat Blue 5

1.Name: Bromo indigo; Vat bromo-indigo; C.I.Vat blue 5;

2.Structure formula:

3.Molecule formula: C16H6Br4N2O2

4.CAS No.: 2475-31-2

5.HS code: 3204151000 6.Major usage and instruction: Be mainly used to dye cotton fabrics.

Indigo Blue Vat Blue

1.Name: indigo blue,vat blue 1,

2.Structure formula:

3.Molecule formula: C16H10N2O2

4.. CAS No.: 482-89-3

5.Molecule weight: 262.62

6.HS code: 3204151000

7.Major usage and instruction: Be mainly used to dye cotton fabrics.