Best VAT Blue 1 - Premium Quality Dye for Textile Applications

Exploring the Best VAT Strategies for Businesses in 2023 A Deep Dive into Blue Innovations

As we navigate through 2023, businesses across various industries continue to grapple with the complexities of Value Added Tax (VAT). The concept itself, though fundamentally simple, often becomes a source of confusion and headaches for entrepreneurs. However, recent innovations and best practices, particularly in the realm of digital technology, have paved the way for what can be termed as best VAT blue,” evolving the landscape of VAT compliance and strategy.

Understanding VAT A Foundation for Success

Value Added Tax is a consumption tax levied on the value added to goods and services. It is crucial for businesses to understand their VAT obligations to avoid penalties and ensure compliance. With varying VAT rates and regulations across different jurisdictions, businesses must also remain adaptable while managing their tax liabilities effectively.

2023 highlights a significant trend towards digitization in the realm of VAT compliance. Businesses can now leverage blue technologies—an umbrella term representing innovations designed to enhance efficiency and transparency in tax management. This shift not only addresses compliance requirements but also aligns with broader sustainability goals.

Exploring the Best VAT Strategies for Businesses in 2023 A Deep Dive into Blue Innovations

Automation stands at the forefront of the best VAT strategies. By integrating VAT-specific software solutions, businesses can streamline their invoicing processes, ensuring that VAT is calculated correctly and recorded accurately. Automation minimizes human error and reduces the workload on finance teams, allowing them to focus on strategic activities rather than mundane data entry tasks.

best vat blue 1

Moreover, automated systems can adapt to real-time regulatory changes, ensuring that businesses remain compliant with the latest tax rules without the need for constant manual updates. This capability is vital as governments around the world continuously refine their tax regulations.

Emphasizing Data Analytics for Strategic Decision Making

Another critical aspect of the best VAT blue approach involves the use of data analytics. Businesses can now gather and analyze vast amounts of transactional data to gain insights into their VAT positions. By employing advanced analytics, companies can identify patterns, spot anomalies, and forecast potential VAT liabilities more accurately.

This data-driven approach not only aids in compliance but also allows businesses to optimize their VAT positions strategically. For instance, understanding the implications of cross-border transactions can lead to better planning and potentially lower VAT costs.

Fostering Collaboration with Tax Professionals

Finally, building a collaborative framework between in-house teams and external tax professionals remains integral to achieving optimal VAT management. As regulations evolve, expert advice becomes invaluable. Tax professionals can provide insights that help businesses navigate the intricacies of VAT, especially concerning international transactions and digital services.

In conclusion, 2023 presents a unique opportunity for businesses to harness the power of best VAT blue—leveraging technology, automation, and data analytics to streamline compliance and optimize VAT strategies. By adopting these innovations, organizations can not only ensure compliance but also gain a competitive edge in the marketplace. Embracing this transformation is essential for businesses aiming to thrive in an increasingly complex tax environment.

-

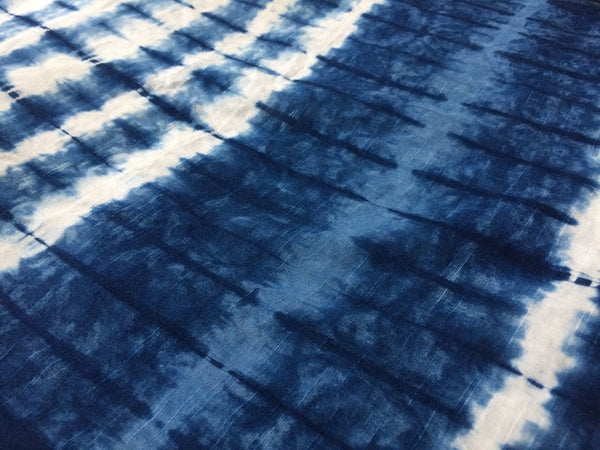

The Timeless Art of Denim Indigo Dye

NewsJul.01,2025

-

The Rise of Sulfur Dyed Denim

NewsJul.01,2025

-

The Rich Revival of the Best Indigo Dye

NewsJul.01,2025

-

The Enduring Strength of Sulphur Black

NewsJul.01,2025

-

The Ancient Art of Chinese Indigo Dye

NewsJul.01,2025

-

Industry Power of Indigo

NewsJul.01,2025

-

Black Sulfur is Leading the Next Wave

NewsJul.01,2025

Sulphur Black

1.Name: sulphur black; Sulfur Black; Sulphur Black 1;

2.Structure formula:

3.Molecule formula: C6H4N2O5

4.CAS No.: 1326-82-5

5.HS code: 32041911

6.Product specification:Appearance:black phosphorus flakes; black liquid

Bromo Indigo; Vat Bromo-Indigo; C.I.Vat Blue 5

1.Name: Bromo indigo; Vat bromo-indigo; C.I.Vat blue 5;

2.Structure formula:

3.Molecule formula: C16H6Br4N2O2

4.CAS No.: 2475-31-2

5.HS code: 3204151000 6.Major usage and instruction: Be mainly used to dye cotton fabrics.

Indigo Blue Vat Blue

1.Name: indigo blue,vat blue 1,

2.Structure formula:

3.Molecule formula: C16H10N2O2

4.. CAS No.: 482-89-3

5.Molecule weight: 262.62

6.HS code: 3204151000

7.Major usage and instruction: Be mainly used to dye cotton fabrics.