discount vat dye indigo

Understanding Discount, VAT, and Indigo Dye in Today's Market

In the textile industry, the significance of indigo dye cannot be overstated. Known for its deep blue hue, indigo dye has been a favorite among designers and manufacturers for centuries. However, in recent years, the complexities surrounding the pricing of indigo dye, particularly concerning discounts and value-added tax (VAT), have become crucial topics for businesses across the globe.

Understanding Discount, VAT, and Indigo Dye in Today's Market

Value-added tax is a consumption tax levied on the value added to goods and services at each stage of production or distribution. For businesses that deal with dyes, such as indigo, VAT can significantly influence pricing strategies. Companies must calculate their prices carefully to ensure that discounts applied still allow for a profit margin after the VAT is accounted for. The intricacies of the VAT system mean that businesses must stay informed about current rates, compliance requirements, and any potential changes in legislation.

discount vat dye indigo

For instance, if an indigo dye supplier offers a 20% discount on their product, they need to consider how this discount will be applied in relation to VAT. If the VAT is 20%, the calculation must factor in both the discounted price and the tax to ensure that the final price to customers remains profitable. This dual consideration can be complex but is necessary for sustainable business practices.

Moreover, businesses that include indigo dye in their offerings must not only be responsive to market demand but also aware of global trends in sustainability. The production of traditional indigo dye has been criticized for its environmental impact. Many companies are now looking to source more sustainable alternatives, such as synthetic indigo or natural dyes, which could also affect pricing and discounts.

In conclusion, managing discounts and VAT effectively is essential for businesses involved in the indigo dye industry. As the market evolves, companies must adapt their pricing strategies while maintaining compliance with tax regulations. Understanding the delicate balance between pricing, discounts, and VAT is key to sustaining profitability and meeting the demands of environmentally-conscious consumers. As the industry continues to grow, staying informed and agile will be paramount for success in the vibrant world of indigo dye.

-

The Timeless Art of Denim Indigo Dye

NewsJul.01,2025

-

The Rise of Sulfur Dyed Denim

NewsJul.01,2025

-

The Rich Revival of the Best Indigo Dye

NewsJul.01,2025

-

The Enduring Strength of Sulphur Black

NewsJul.01,2025

-

The Ancient Art of Chinese Indigo Dye

NewsJul.01,2025

-

Industry Power of Indigo

NewsJul.01,2025

-

Black Sulfur is Leading the Next Wave

NewsJul.01,2025

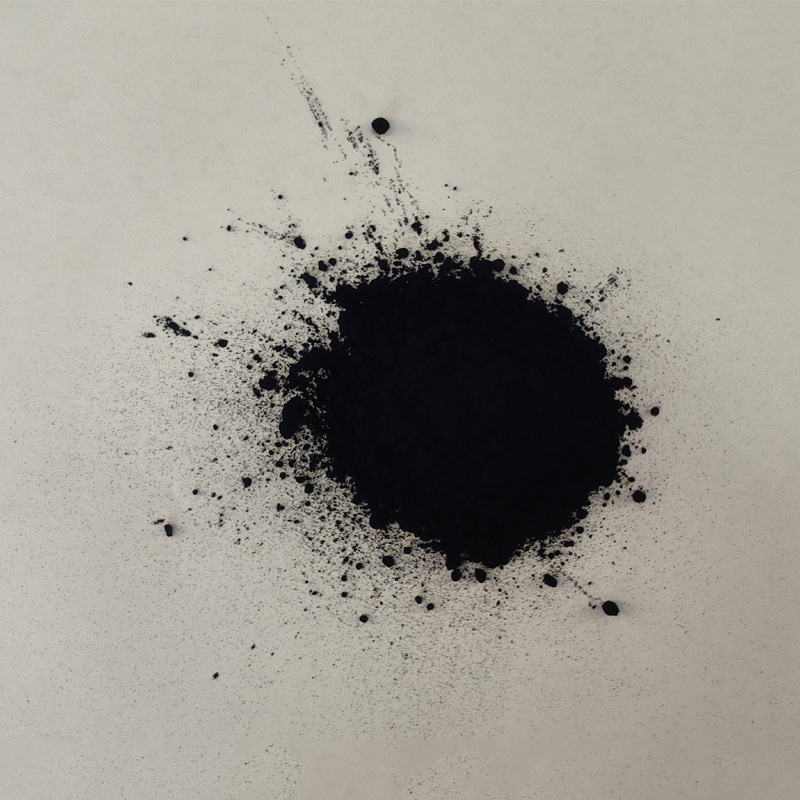

Sulphur Black

1.Name: sulphur black; Sulfur Black; Sulphur Black 1;

2.Structure formula:

3.Molecule formula: C6H4N2O5

4.CAS No.: 1326-82-5

5.HS code: 32041911

6.Product specification:Appearance:black phosphorus flakes; black liquid

Bromo Indigo; Vat Bromo-Indigo; C.I.Vat Blue 5

1.Name: Bromo indigo; Vat bromo-indigo; C.I.Vat blue 5;

2.Structure formula:

3.Molecule formula: C16H6Br4N2O2

4.CAS No.: 2475-31-2

5.HS code: 3204151000 6.Major usage and instruction: Be mainly used to dye cotton fabrics.

Indigo Blue Vat Blue

1.Name: indigo blue,vat blue 1,

2.Structure formula:

3.Molecule formula: C16H10N2O2

4.. CAS No.: 482-89-3

5.Molecule weight: 262.62

6.HS code: 3204151000

7.Major usage and instruction: Be mainly used to dye cotton fabrics.