Exploring the Features and Benefits of VAT Blue 1 Product for Various Applications

Understanding VAT on Blue 1 Products A Comprehensive Overview

Value Added Tax (VAT) is a consumption tax levied on the value added to goods and services at each stage of production or distribution. One interesting case is the VAT implications related to specific products, such as Blue 1, a product that has gained attention within various industries. In this article, we will delve into the concept of VAT, its application on Blue 1 products, and the significance of understanding these implications for consumers and businesses alike.

What is Blue 1?

Blue 1, chemically known as Brilliant Blue FCF, is a synthetic dye commonly used in food products, cosmetics, and pharmaceuticals. It is recognized for its vibrant blue hue, which enhances the visual appeal of various items. While it is generally considered safe for consumption and use, understanding the taxation mechanisms surrounding such products is essential for both manufacturers and consumers.

VAT Basics

VAT is a tax that is applied at each stage of the supply chain. It is ultimately borne by the end consumer, but businesses must identify and collect this tax on behalf of the government. Different countries have varying VAT rates, and certain products may be subject to reduced rates or exemptions based on their nature and usage. For instance, food items might have a lower VAT rate compared to luxury goods.

VAT on Blue 1 Products

vat blue 1 product

When it comes to products containing Blue 1, the VAT implications can vary depending on the classification of the product involved. For example, in the EU, foodstuffs are typically exempt from VAT or subject to a reduced rate, whereas cosmetics may be charged the standard VAT rate. This differentiation is crucial for manufacturers and retailers, as it affects pricing strategies and overall compliance.

If Blue 1 is utilized in a food product, the manufacturer must check if the food item qualifies for VAT exemption or a reduced rate. For instance, many basic food products may be zero-rated, meaning they are not charged VAT at all. Conversely, if Blue 1 is used in non-essential food items or luxury goods, the standard VAT rate may apply. The proper categorization not only impacts the cost to the consumer but also the financial health of the business.

Impact on Consumers and Businesses

Understanding VAT implications is essential for both parties. Consumers need to be aware of how VAT affects the final price of products they purchase, including those containing Blue 1. For businesses, misclassifying a product can lead to significant financial penalties, loss of consumer trust, and competitive disadvantages.

Moreover, as consumers become increasingly aware of what they are buying, transparency regarding the ingredients and their associated costs, including VAT, becomes vital. Products that openly disclose these details can build trust and foster loyalty among customers.

Conclusion

In conclusion, the relationship between VAT and Blue 1 products highlights the broader complexities of taxation in the global marketplace. Companies involved in the production and sale of products containing Blue 1 must navigate these VAT implications carefully to ensure compliance and competitive pricing. Consumers, on the other hand, benefit from understanding how VAT influences the cost of the products they purchase. As the landscape of food and cosmetic regulations continues to evolve, staying informed about VAT and its applications remains crucial for all stakeholders involved. This enhanced knowledge can lead to more informed choices for consumers while helping businesses operate effectively within the legal frameworks governing taxation.

-

The Timeless Art of Denim Indigo Dye

NewsJul.01,2025

-

The Rise of Sulfur Dyed Denim

NewsJul.01,2025

-

The Rich Revival of the Best Indigo Dye

NewsJul.01,2025

-

The Enduring Strength of Sulphur Black

NewsJul.01,2025

-

The Ancient Art of Chinese Indigo Dye

NewsJul.01,2025

-

Industry Power of Indigo

NewsJul.01,2025

-

Black Sulfur is Leading the Next Wave

NewsJul.01,2025

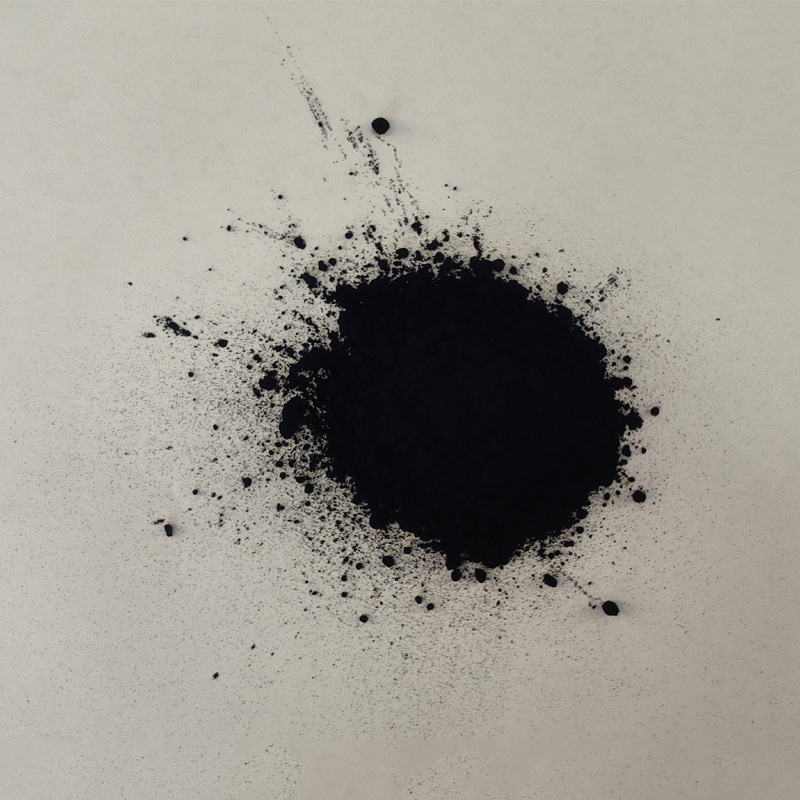

Sulphur Black

1.Name: sulphur black; Sulfur Black; Sulphur Black 1;

2.Structure formula:

3.Molecule formula: C6H4N2O5

4.CAS No.: 1326-82-5

5.HS code: 32041911

6.Product specification:Appearance:black phosphorus flakes; black liquid

Bromo Indigo; Vat Bromo-Indigo; C.I.Vat Blue 5

1.Name: Bromo indigo; Vat bromo-indigo; C.I.Vat blue 5;

2.Structure formula:

3.Molecule formula: C16H6Br4N2O2

4.CAS No.: 2475-31-2

5.HS code: 3204151000 6.Major usage and instruction: Be mainly used to dye cotton fabrics.

Indigo Blue Vat Blue

1.Name: indigo blue,vat blue 1,

2.Structure formula:

3.Molecule formula: C16H10N2O2

4.. CAS No.: 482-89-3

5.Molecule weight: 262.62

6.HS code: 3204151000

7.Major usage and instruction: Be mainly used to dye cotton fabrics.