Exploring the Latest Indigo Pricing and VAT Information for Your Business Needs

Understanding the VAT Indigo Pricelist A Comprehensive Overview

In today’s dynamic marketplace, understanding pricing structures is essential for both consumers and businesses. One of the crucial elements in pricing, especially in the textile and fabric industry, is the Value Added Tax (VAT). This article delves into the VAT Indigo pricelist, explaining its significance and implications for buyers and sellers alike.

What is Indigo Fabric?

Indigo fabric refers to textiles that have been dyed with indigo, a natural dye derived from the leaves of the indigo plant. This deep blue color has been prized for centuries, primarily used in denim production. The unique appeal of indigo lies not only in its rich color but also in its ability to fade beautifully over time, giving each piece a distinct character.

Importance of Pricing Lists

The pricing list for indigo fabric plays a crucial role in the textile market. It provides transparency and helps standardize prices across different suppliers and retailers. A well-structured pricelist includes various details such as fabric quality, dyeing processes, and additional features like organic certifications. This is where VAT comes into play, impacting overall costs.

Understanding VAT in the Textile Industry

Value Added Tax (VAT) is a consumption tax placed on a product whenever value is added at each stage of production and at the point of sale. In the context of the indigo fabric market, VAT affects manufacturers, retailers, and consumers. Typically, VAT rates vary from one country to another, and they can significantly influence the final retail price of fabrics.

For instance, if a manufacturer purchases raw indigo fabric and incurs a VAT of 20%, this cost is factored into the pricing. Consequently, when the retailer sells the finished fabric, they must calculate the VAT again, leading to an additional cost for the end consumer. Depending on the country’s VAT regulations, the final consumer price may contain 5% to 25% of the original price as VAT.

The VAT Indigo Pricelist

vat indigo pricelist

A VAT Indigo pricelist typically provides a breakdown of the costs associated with different types of indigo fabrics while clearly indicating how VAT applies to each item. For instance, a pricelist might look like the following

- Indigo Dyed Cotton Fabric (100% Cotton) - Price per meter $10.00 - VAT (20%) $2.00 - Total Price $12.00

- Organic Indigo Denim - Price per meter $15.00 - VAT (20%) $3.00 - Total Price $18.00

This clear breakdown helps consumers understand exactly what they are paying for and allows businesses to maintain transparency, fostering trust.

Implications for Consumers and Retailers

For consumers, understanding the VAT Indigo pricelist is vital for making informed purchasing decisions. Recognizing that part of what they pay goes toward tax can help them assess the value of what they’re buying, especially if they’re considering ethical factors such as sustainable sourcing or organic certification.

For retailers, a well-structured VAT Indigo pricelist not only aids in compliance with tax regulations but also facilitates strategic pricing. By being transparent about VAT, retailers can clarify misconceptions about pricing and defend their pricing strategies to consumers.

Conclusion

The VAT Indigo pricelist is more than just numbers on a page; it reflects the intricacies of pricing in the textile industry affected by taxes. By understanding this concept, both consumers and businesses can navigate the complexities of the fabric market more effectively. Whether for personal use or resale, being informed about VAT implications can lead to smarter and more sustainable purchasing decisions, benefiting everyone involved in the supply chain.

-

The Timeless Art of Denim Indigo Dye

NewsJul.01,2025

-

The Rise of Sulfur Dyed Denim

NewsJul.01,2025

-

The Rich Revival of the Best Indigo Dye

NewsJul.01,2025

-

The Enduring Strength of Sulphur Black

NewsJul.01,2025

-

The Ancient Art of Chinese Indigo Dye

NewsJul.01,2025

-

Industry Power of Indigo

NewsJul.01,2025

-

Black Sulfur is Leading the Next Wave

NewsJul.01,2025

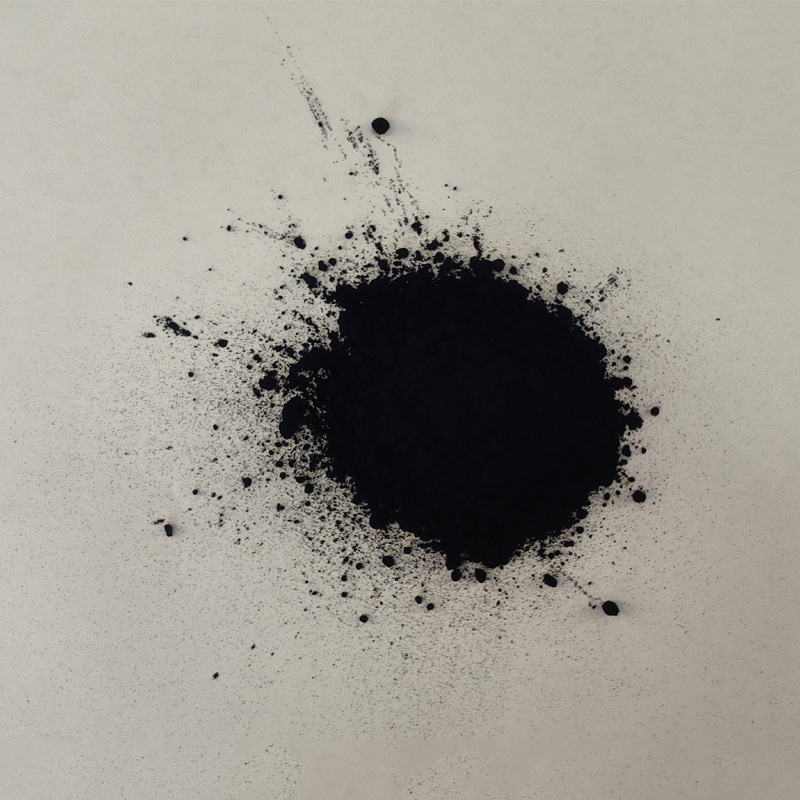

Sulphur Black

1.Name: sulphur black; Sulfur Black; Sulphur Black 1;

2.Structure formula:

3.Molecule formula: C6H4N2O5

4.CAS No.: 1326-82-5

5.HS code: 32041911

6.Product specification:Appearance:black phosphorus flakes; black liquid

Bromo Indigo; Vat Bromo-Indigo; C.I.Vat Blue 5

1.Name: Bromo indigo; Vat bromo-indigo; C.I.Vat blue 5;

2.Structure formula:

3.Molecule formula: C16H6Br4N2O2

4.CAS No.: 2475-31-2

5.HS code: 3204151000 6.Major usage and instruction: Be mainly used to dye cotton fabrics.

Indigo Blue Vat Blue

1.Name: indigo blue,vat blue 1,

2.Structure formula:

3.Molecule formula: C16H10N2O2

4.. CAS No.: 482-89-3

5.Molecule weight: 262.62

6.HS code: 3204151000

7.Major usage and instruction: Be mainly used to dye cotton fabrics.