vat blue 1 supplier

Understanding VAT Blue 1 Supplier A Comprehensive Overview

Value Added Tax (VAT) is a critical component of business operations in many countries, serving as a consumption tax placed on goods and services. Among the diverse classifications of VAT suppliers, the term VAT Blue 1 Supplier specifically encompasses entities that comply with specific regulatory frameworks and tax obligations. This article delves into what defines a VAT Blue 1 Supplier, their significance in the market, and the implications of such classification for businesses and consumers alike.

Definition of VAT Blue 1 Supplier

A VAT Blue 1 Supplier is typically characterized as a supplier who has registered for VAT and follows stringent guidelines set by the tax authorities. This classification may vary from country to country, but it often includes suppliers who demonstrate a strong compliance record with VAT regulations, ensuring transparency and accountability in their operations. These suppliers are likely to provide essential documentation that illustrates their adherence to tax laws, which not only aids in streamlining tax processes but also boosts consumer confidence.

Importance in Business Operations

The classification as a VAT Blue 1 Supplier carries substantial weight in the business realm. Firstly, it allows the supplier to issue VAT-compliant invoices, making it easier for businesses and consumers to reclaim VAT on their purchases. This recovery is critical, especially for businesses operating within the value-added tax framework, where input VAT can significantly impact cash flow and bottom-line profitability. Furthermore, being recognized as a VAT Blue 1 Supplier often enhances a company's reputation, as customers tend to prefer engaged suppliers who maintain compliance with tax obligations.

vat blue 1 supplier

Benefits for Consumers

For consumers, dealing with VAT Blue 1 Suppliers offers several advantages. The primary benefit lies in the assurance of fair pricing; since these suppliers are required to operate transparently in their pricing methodologies, consumers can trust that they are being charged the appropriate amount of VAT applicable to their purchases. Additionally, consumers can be confident that the services and products they acquire from VAT Blue 1 Suppliers are legitimate, reducing the risks associated with tax evasion or fraudulent business practices.

Challenges Faced

While the status of a VAT Blue 1 Supplier provides numerous benefits, there are also challenges that such suppliers must navigate. The regulatory requirements can be demanding, requiring consistent documentation and adherence to a multitude of tax regulations. This process may necessitate dedicated resources and personnel to manage accounting and compliance, which could be burdensome for smaller suppliers. Additionally, fluctuations in VAT rates or changes in tax legislation can further complicate compliance efforts, requiring suppliers to stay constantly informed to avoid penalties.

Conclusion

In conclusion, the classification of a VAT Blue 1 Supplier symbolizes a commitment to transparency, compliance, and ethical business practices. For businesses, it simplifies VAT management and enhances credibility, while consumers can enjoy fairer pricing and assurance of legitimacy. Understanding the implications of this supplier classification is essential for all stakeholders, fostering an environment where trustworthy transactions can occur and the economy can thrive. As businesses continue to navigate the complexities of VAT, the role of VAT Blue 1 Suppliers will remain pivotal in promoting sustainable and compliant economic growth.

-

The Timeless Art of Denim Indigo Dye

NewsJul.01,2025

-

The Rise of Sulfur Dyed Denim

NewsJul.01,2025

-

The Rich Revival of the Best Indigo Dye

NewsJul.01,2025

-

The Enduring Strength of Sulphur Black

NewsJul.01,2025

-

The Ancient Art of Chinese Indigo Dye

NewsJul.01,2025

-

Industry Power of Indigo

NewsJul.01,2025

-

Black Sulfur is Leading the Next Wave

NewsJul.01,2025

Sulphur Black

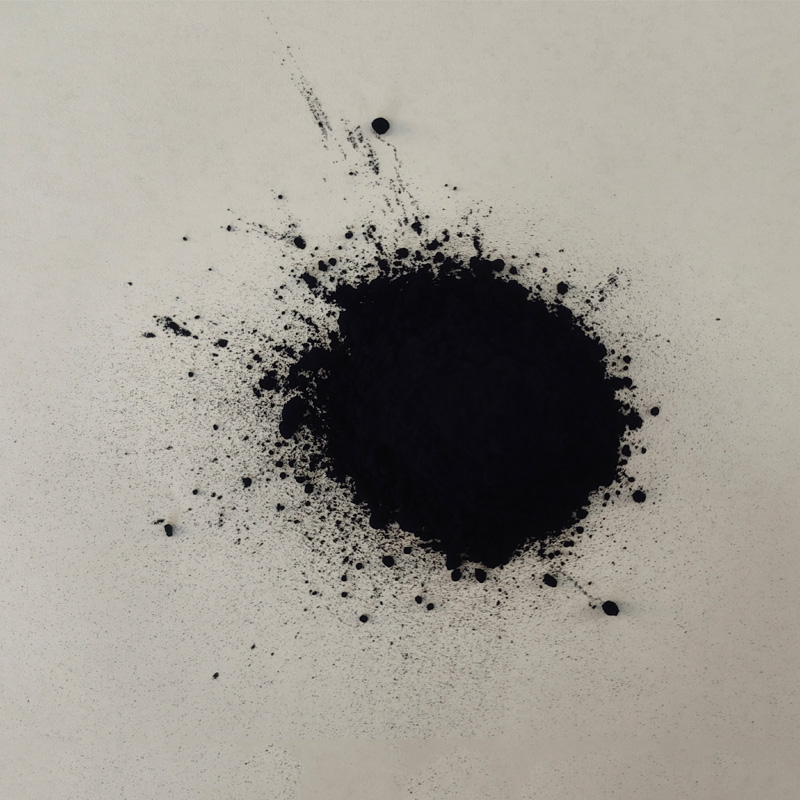

1.Name: sulphur black; Sulfur Black; Sulphur Black 1;

2.Structure formula:

3.Molecule formula: C6H4N2O5

4.CAS No.: 1326-82-5

5.HS code: 32041911

6.Product specification:Appearance:black phosphorus flakes; black liquid

Bromo Indigo; Vat Bromo-Indigo; C.I.Vat Blue 5

1.Name: Bromo indigo; Vat bromo-indigo; C.I.Vat blue 5;

2.Structure formula:

3.Molecule formula: C16H6Br4N2O2

4.CAS No.: 2475-31-2

5.HS code: 3204151000 6.Major usage and instruction: Be mainly used to dye cotton fabrics.

Indigo Blue Vat Blue

1.Name: indigo blue,vat blue 1,

2.Structure formula:

3.Molecule formula: C16H10N2O2

4.. CAS No.: 482-89-3

5.Molecule weight: 262.62

6.HS code: 3204151000

7.Major usage and instruction: Be mainly used to dye cotton fabrics.