Creating a for VAT Blue 1 Company with Similar Theme in 15 Words or Less

Understanding VAT, Blue 1 Company, and Its Impact on Business Operations

Value Added Tax (VAT) is a critical concept in global commerce, serving as a primary source of revenue for governments around the world. It is a consumption tax assessed at each stage of the production and distribution process, ultimately borne by the end consumer. In this article, we will explore the nuances of VAT, using a fictional company named Blue 1 Company as a case study. Through this analysis, we aim to demonstrate how VAT affects business operations, pricing strategies, and overall financial management.

What is VAT?

VAT is typically charged as a percentage of the sale price of goods and services. It is levied at each point of sale, from manufacturing to the final retail stage. Businesses collect VAT from customers on behalf of the government, and this revenue is then remitted periodically. The rate of VAT varies by country and sometimes even by product category within a country. Common rates range from 5% to 25%, making it essential for companies to have a clear understanding of the VAT landscape in their operational regions.

Blue 1 Company An Overview

Imagine Blue 1 Company as a mid-sized manufacturer specializing in high-quality electronics. Based in a country with a VAT of 20%, Blue 1 must navigate the complexities of tax compliance while also ensuring its pricing strategies remain competitive. For Blue 1, understanding VAT is not merely an accounting function; it directly impacts cash flow, pricing strategy, and competitive positioning.

The Financial Implications of VAT

Incorporating VAT into the financial operations of Blue 1 involves several critical considerations. First, the company must assess how VAT will affect its pricing strategy. For instance, if Blue 1 wants to offer a new electronic gadget priced at $100 before VAT, it needs to account for the additional 20%. As a result, the final consumer price becomes $120. Understanding this price point is essential for positioning the product in a competitive market.

Another crucial aspect is cash flow management. Blue 1 collects VAT from customers but also pays VAT on its purchases of raw materials and services. Thus, effective VAT management becomes vital. Blue 1 can reclaim the VAT paid on inputs, which reduces the amount owed to the government. However, timing is crucial; if the company purchases materials and pays VAT upfront but does not receive payment from its customers until later, it may face temporary cash flow issues.

vat blue 1 company

Compliance and Management Challenges

For Blue 1 Company, VAT compliance poses ongoing challenges. The company must maintain meticulous records of all transactions, ensuring that VAT is accurately calculated and reported. This involves not only the sales process but also any purchases made during production. Additionally, any updates in VAT legislation, such as changes in rates or exemptions, require quick adaptation to maintain compliance.

Furthermore, exporting goods can complicate VAT management. In many jurisdictions, exports may be zero-rated for VAT purposes, meaning that no VAT is charged on goods sold abroad. This can create a competitive advantage for Blue 1, but the company must navigate the processes for claiming back the VAT on inputs associated with those exports.

Strategic Advantages of Understanding VAT

While navigating VAT can be daunting, Blue 1 Company has the opportunity to turn these challenges into strategic advantages. By thoroughly understanding VAT, the company can enhance its pricing strategies—offering promotions that account for the tax effect or adjusting prices to remain competitive without compromising profit margins. Additionally, effective VAT management can improve supplier relationships, as timely VAT reclaim processes can enhance cash flow.

Moreover, the company can leverage VAT knowledge in its marketing strategies. By clearly communicating the VAT-inclusive pricing to consumers, Blue 1 helps in establishing transparency and fostering trust. Education regarding how VAT affects pricing can also enhance brand loyalty among customers who appreciate clarity and fairness.

Conclusion

In conclusion, VAT is more than just a compliance concern; it is a significant factor influencing the operations of businesses like Blue 1 Company. Understanding the implications of VAT on pricing, cash flow, and compliance is essential for success in today’s marketplace. By navigating the complexities of VAT effectively, Blue 1 can transform challenges into opportunities, positioning itself for sustainable growth in a competitive environment. As the landscape of commerce continues to evolve, companies that embrace a robust understanding of VAT will undoubtedly maintain a strategic edge.

-

The Timeless Art of Denim Indigo Dye

NewsJul.01,2025

-

The Rise of Sulfur Dyed Denim

NewsJul.01,2025

-

The Rich Revival of the Best Indigo Dye

NewsJul.01,2025

-

The Enduring Strength of Sulphur Black

NewsJul.01,2025

-

The Ancient Art of Chinese Indigo Dye

NewsJul.01,2025

-

Industry Power of Indigo

NewsJul.01,2025

-

Black Sulfur is Leading the Next Wave

NewsJul.01,2025

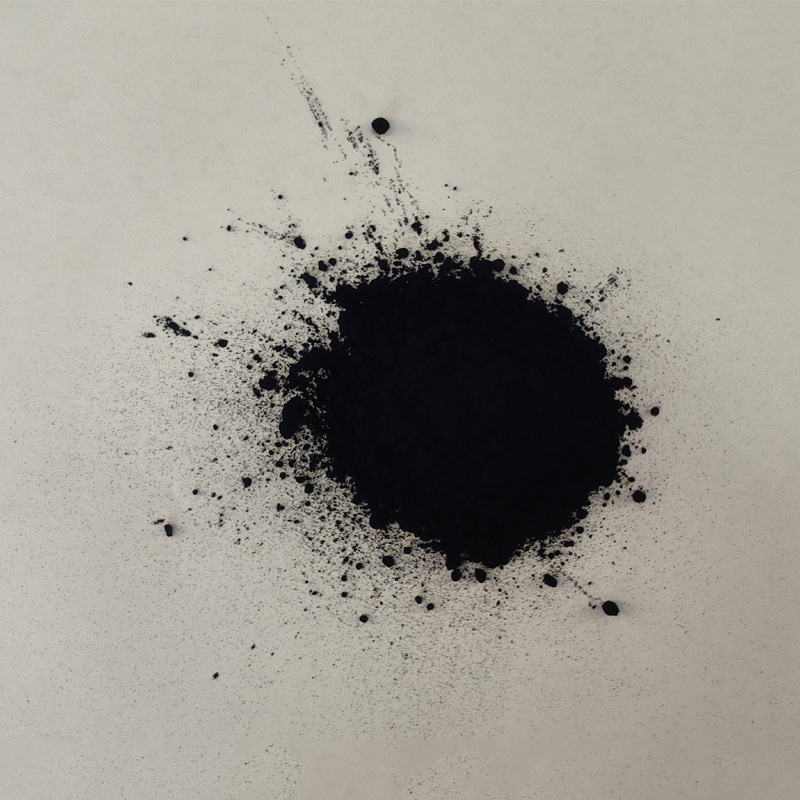

Sulphur Black

1.Name: sulphur black; Sulfur Black; Sulphur Black 1;

2.Structure formula:

3.Molecule formula: C6H4N2O5

4.CAS No.: 1326-82-5

5.HS code: 32041911

6.Product specification:Appearance:black phosphorus flakes; black liquid

Bromo Indigo; Vat Bromo-Indigo; C.I.Vat Blue 5

1.Name: Bromo indigo; Vat bromo-indigo; C.I.Vat blue 5;

2.Structure formula:

3.Molecule formula: C16H6Br4N2O2

4.CAS No.: 2475-31-2

5.HS code: 3204151000 6.Major usage and instruction: Be mainly used to dye cotton fabrics.

Indigo Blue Vat Blue

1.Name: indigo blue,vat blue 1,

2.Structure formula:

3.Molecule formula: C16H10N2O2

4.. CAS No.: 482-89-3

5.Molecule weight: 262.62

6.HS code: 3204151000

7.Major usage and instruction: Be mainly used to dye cotton fabrics.