vat indigo blue supplier

VAT and Indigo Blue Suppliers A Comprehensive Overview

Indigo blue, a rich and vibrant color, has been a significant hue in textiles, arts, and design for centuries. Its deep, evocative tone has captured the imagination of artisans, fashion designers, and consumers alike. However, in a global marketplace, the procurement of indigo blue pigments, especially through sustainable and ethical practices, has become increasingly important. This is where understanding Value Added Tax (VAT) and its implications on indigo blue suppliers comes into play.

VAT and Indigo Blue Suppliers A Comprehensive Overview

When sourcing indigo blue pigments, suppliers need to establish relationships with manufacturers that adhere to ethical and sustainable practices. The traditional method of producing indigo dye involves labor-intensive processes, often in regions where craftsmanship has been passed down through generations. However, the rise of synthetic indigo has changed the landscape, prompting many suppliers to consider eco-friendly alternatives that minimize environmental impact. This shift is particularly relevant in the context of VAT, as eco-friendly products may qualify for lower rates or special regulations designed to encourage sustainable consumer behavior.

vat indigo blue supplier

In addition to environmental considerations, suppliers must also keep an eye on regulatory frameworks surrounding VAT. Proper documentation and invoicing are essential to ensure that VAT is correctly accounted for and that suppliers are compliant with local laws. This ensures that they can pass on any VAT benefits to customers, potentially making their offerings more attractive. Moreover, suppliers should be prepared to educate their customers about VAT and its implications on pricing, which can enhance trust and transparency in transactions.

As the demand for indigo blue continues to rise across various industries, from fashion to home decor, suppliers must remain adaptable. This involves not only navigating VAT regulations but also staying updated on market trends, consumer preferences, and technological advancements in dye production. By maintaining a strong focus on sustainability while also managing VAT implications, indigo blue suppliers can carve out a niche that appeals to modern consumers who are increasingly conscious about the environmental and ethical footprints of their purchases.

In conclusion, VAT plays a critical role in the business strategy of indigo blue suppliers. By understanding the nuances of tax regulations, emphasizing sustainability, and ensuring transparency with customers, suppliers can thrive in a competitive marketplace while celebrating the rich heritage of this timeless color.

-

The Timeless Art of Denim Indigo Dye

NewsJul.01,2025

-

The Rise of Sulfur Dyed Denim

NewsJul.01,2025

-

The Rich Revival of the Best Indigo Dye

NewsJul.01,2025

-

The Enduring Strength of Sulphur Black

NewsJul.01,2025

-

The Ancient Art of Chinese Indigo Dye

NewsJul.01,2025

-

Industry Power of Indigo

NewsJul.01,2025

-

Black Sulfur is Leading the Next Wave

NewsJul.01,2025

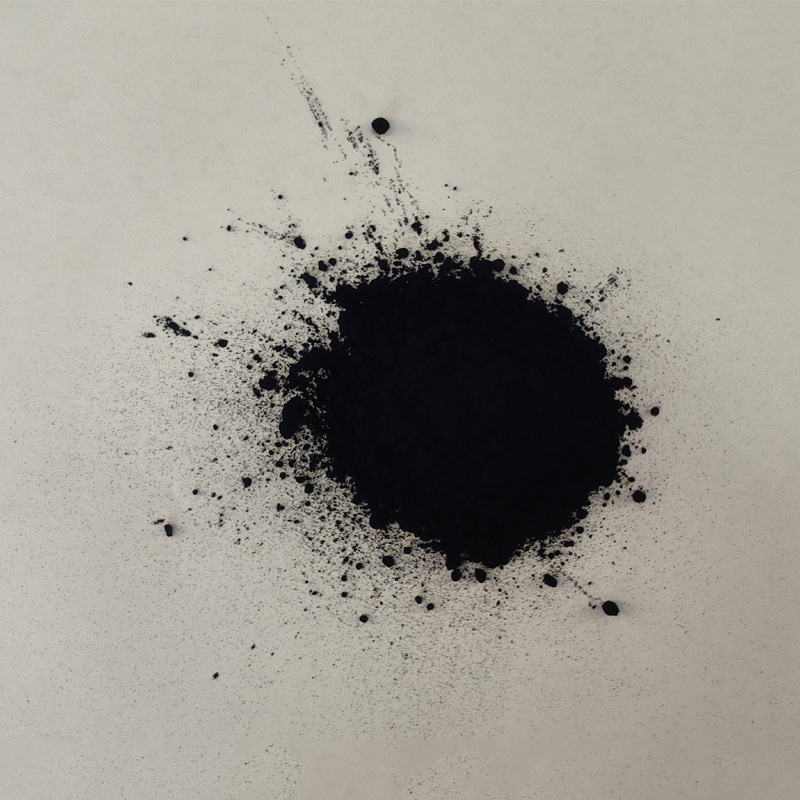

Sulphur Black

1.Name: sulphur black; Sulfur Black; Sulphur Black 1;

2.Structure formula:

3.Molecule formula: C6H4N2O5

4.CAS No.: 1326-82-5

5.HS code: 32041911

6.Product specification:Appearance:black phosphorus flakes; black liquid

Bromo Indigo; Vat Bromo-Indigo; C.I.Vat Blue 5

1.Name: Bromo indigo; Vat bromo-indigo; C.I.Vat blue 5;

2.Structure formula:

3.Molecule formula: C16H6Br4N2O2

4.CAS No.: 2475-31-2

5.HS code: 3204151000 6.Major usage and instruction: Be mainly used to dye cotton fabrics.

Indigo Blue Vat Blue

1.Name: indigo blue,vat blue 1,

2.Structure formula:

3.Molecule formula: C16H10N2O2

4.. CAS No.: 482-89-3

5.Molecule weight: 262.62

6.HS code: 3204151000

7.Major usage and instruction: Be mainly used to dye cotton fabrics.