vat indigo blue supplier

Exploring VAT in Indigo Blue Supply A Comprehensive Guide

The world of supply chain management is increasingly complex, particularly when dealing with specialized products such as indigo blue dye. One aspect that cannot be overlooked is the Value Added Tax (VAT) implications associated with such supplies. This article aims to elucidate the intricacies of VAT in the context of indigo blue suppliers, providing insights into best practices for compliance and optimization.

Understanding VAT

Value Added Tax (VAT) is an indirect tax levied at each stage of production and distribution. It is common in many countries worldwide, particularly in Europe. The concept of VAT is relatively straightforward it is applied to the value added to goods and services at each step of the sales process. For businesses involved in the supply of indigo blue, understanding the VAT framework is critical for effective financial management.

The Indigo Blue Supply Chain

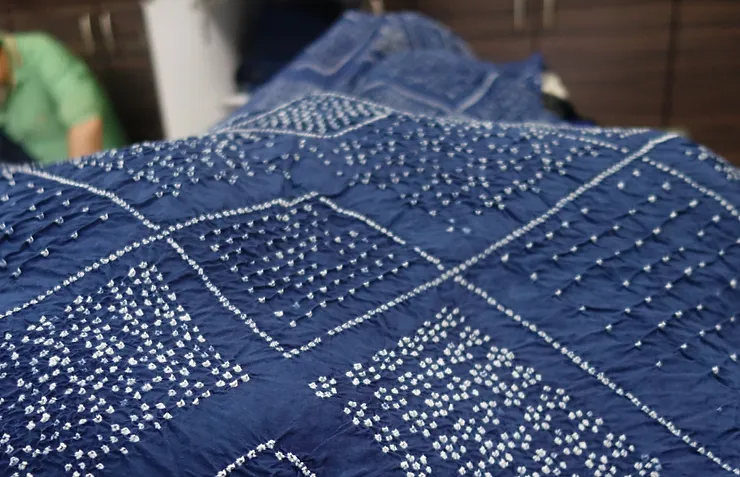

Indigo blue dye is derived from the indigo plant and has a rich history in textiles, arts, and crafts. The supply chain for indigo blue involves several steps, including cultivation, extraction, manufacturing, and distribution. Each stage of this process is subject to VAT regulations that can vary significantly by country. For instance, in the European Union, VAT rates can differ not only from one member state to another but also across different types of goods and services.

VAT Applicability on Indigo Blue Supplies

When suppliers of indigo blue engage in commercial transactions, it's crucial to determine the correct VAT rate. Here are some considerations

1. Nature of the Product Indigo blue can be classified as either a raw material or a manufactured product, which may affect its VAT rate. For example, raw plant materials may have a lower VAT rate compared to processed dyes or textile products.

2. Country of Supply Different countries have different VAT rates and exemptions. Suppliers must be aware of both their local VAT regulations and those applicable in countries they supply to. This requires staying updated on international VAT laws, as these change frequently.

vat indigo blue supplier

3. Export Considerations Indirect exports of cotton or processed textile goods dyed with indigo blue may have zero-rated VAT conditions in some jurisdictions. Understanding how VAT applies to international sales versus domestic sales is vital for suppliers who engage in cross-border trade.

Best Practices for VAT Compliance

For suppliers of indigo blue, ensuring VAT compliance can save money and prevent legal complications. Here are some best practices

- Register for VAT If your business exceeds the VAT threshold in your jurisdiction, register for VAT to avoid penalties and ensure proper input tax deductions.

- Maintain Accurate Records Keep detailed records of all transactions involving indigo blue supplies. This includes invoices, receipts, and proof of export where necessary. Clear documentation can aid in claiming VAT refunds or handling audits.

- Seek Professional Advice Considering the complexity of VAT laws, consulting with a tax professional or VAT consultant with experience in the textile or dye industries can be invaluable. They can provide tailored advice to minimize tax liabilities and ensure compliance.

- Stay Informed VAT regulations change, so staying informed about new laws, changes in tax rates, or shifts in classification is crucial. Engage with professional organizations or trade associations for the latest updates.

Conclusion

Navigating the VAT landscape as a supplier of indigo blue is essential for successful operations in the current economic environment. By understanding the implications of VAT on your products, adhering to best practices for compliance, and seeking professional guidance, suppliers can optimize their tax strategies while minimizing risks. As the demand for sustainable and natural dyes like indigo blue continues to grow globally, understanding VAT will become an even more critical component of the supply chain for businesses in this sector. Embracing these considerations will not only bolster compliance but also enhance the overall efficiency and profitability of the indigo blue supply chain.

-

The Timeless Art of Denim Indigo Dye

NewsJul.01,2025

-

The Rise of Sulfur Dyed Denim

NewsJul.01,2025

-

The Rich Revival of the Best Indigo Dye

NewsJul.01,2025

-

The Enduring Strength of Sulphur Black

NewsJul.01,2025

-

The Ancient Art of Chinese Indigo Dye

NewsJul.01,2025

-

Industry Power of Indigo

NewsJul.01,2025

-

Black Sulfur is Leading the Next Wave

NewsJul.01,2025

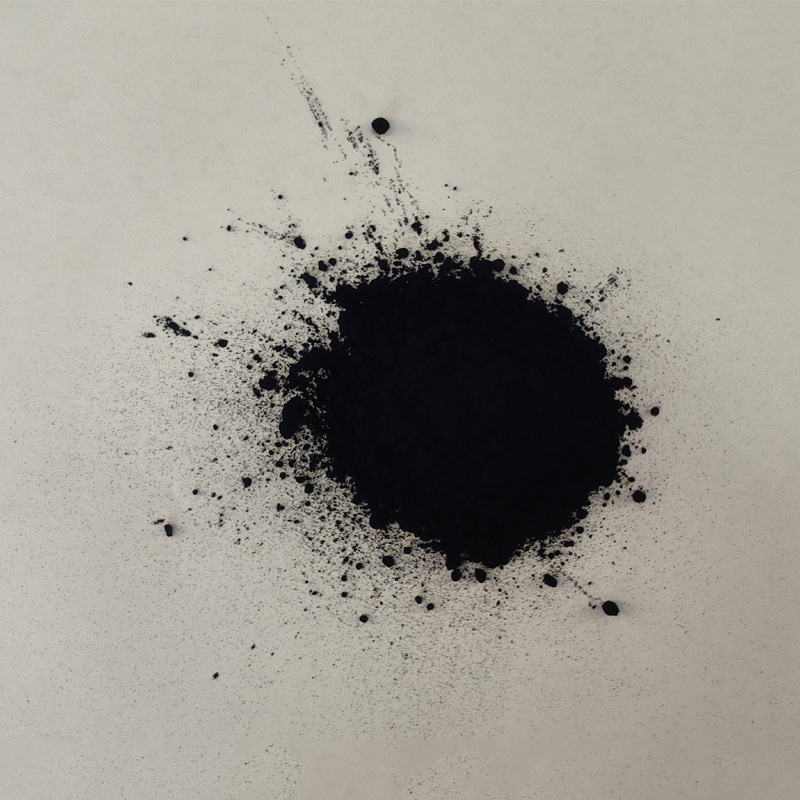

Sulphur Black

1.Name: sulphur black; Sulfur Black; Sulphur Black 1;

2.Structure formula:

3.Molecule formula: C6H4N2O5

4.CAS No.: 1326-82-5

5.HS code: 32041911

6.Product specification:Appearance:black phosphorus flakes; black liquid

Bromo Indigo; Vat Bromo-Indigo; C.I.Vat Blue 5

1.Name: Bromo indigo; Vat bromo-indigo; C.I.Vat blue 5;

2.Structure formula:

3.Molecule formula: C16H6Br4N2O2

4.CAS No.: 2475-31-2

5.HS code: 3204151000 6.Major usage and instruction: Be mainly used to dye cotton fabrics.

Indigo Blue Vat Blue

1.Name: indigo blue,vat blue 1,

2.Structure formula:

3.Molecule formula: C16H10N2O2

4.. CAS No.: 482-89-3

5.Molecule weight: 262.62

6.HS code: 3204151000

7.Major usage and instruction: Be mainly used to dye cotton fabrics.