vat indigo companies

The Role of VAT in Indigo Companies A Deep Dive

Value Added Tax (VAT) is a critical component of the fiscal landscape in many countries, and its implications extend beyond mere revenue generation. For companies dealing with indigo dye—an ancient yet revitalized industry—understanding VAT is essential for compliance and strategic financial management.

The Role of VAT in Indigo Companies A Deep Dive

One major consideration for indigo companies is the VAT rate applicable to their products. Different countries may impose varying rates, which can significantly affect pricing strategies and profit margins. For instance, in some jurisdictions, textiles dyed with indigo may qualify for reduced VAT rates, while others might categorize them under standard rates due to their classification. Understanding the applicable VAT rates can help indigo businesses maintain competitive pricing while ensuring compliance.

vat indigo companies

Furthermore, VAT can influence international trade for indigo companies. When exporting dyed fabrics, businesses must be aware of VAT regulations in both their home country and the destination market. Some countries allow VAT refunds on exported goods, creating an incentive for indigo companies to expand their reach globally. However, navigating VAT compliance in multiple jurisdictions can be complex, requiring detailed record-keeping and an understanding of the tax laws of various markets.

In addition to export considerations, indigo companies must also address the issue of input VAT. This tax on goods and services purchased for the business can often be reclaimed, presenting a vital opportunity for cost management. For instance, a company that purchases raw indigo plants, dyes, or processing equipment may benefit from input VAT recovery, thereby enhancing its financial standing.

Moreover, as sustainability becomes increasingly relevant in global commerce, indigo companies are adopting eco-friendly practices. Some governments offer tax incentives or reduced VAT rates for sustainable products. Indigo companies that prioritize environmental responsibility might find themselves in an advantageous position, receiving both consumer support and financial relief through VAT benefits.

In conclusion, VAT plays a significant role in the operational framework of indigo companies. Understanding the nuances of VAT regulations—such as applicable rates, input recovery opportunities, and international compliance—is essential for strategic planning and business operations. As this industry continues to grow, developing a robust VAT strategy will empower indigo companies to navigate the complexities of taxation and thrive in a competitive market.

-

The Timeless Art of Denim Indigo Dye

NewsJul.01,2025

-

The Rise of Sulfur Dyed Denim

NewsJul.01,2025

-

The Rich Revival of the Best Indigo Dye

NewsJul.01,2025

-

The Enduring Strength of Sulphur Black

NewsJul.01,2025

-

The Ancient Art of Chinese Indigo Dye

NewsJul.01,2025

-

Industry Power of Indigo

NewsJul.01,2025

-

Black Sulfur is Leading the Next Wave

NewsJul.01,2025

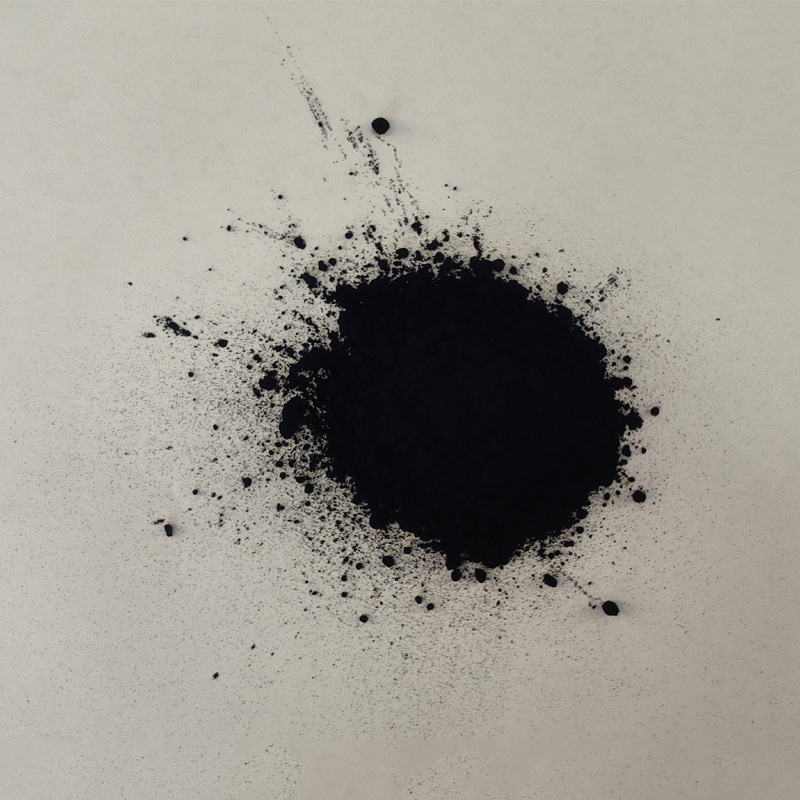

Sulphur Black

1.Name: sulphur black; Sulfur Black; Sulphur Black 1;

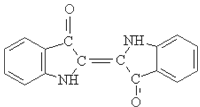

2.Structure formula:

3.Molecule formula: C6H4N2O5

4.CAS No.: 1326-82-5

5.HS code: 32041911

6.Product specification:Appearance:black phosphorus flakes; black liquid

Bromo Indigo; Vat Bromo-Indigo; C.I.Vat Blue 5

1.Name: Bromo indigo; Vat bromo-indigo; C.I.Vat blue 5;

2.Structure formula:

3.Molecule formula: C16H6Br4N2O2

4.CAS No.: 2475-31-2

5.HS code: 3204151000 6.Major usage and instruction: Be mainly used to dye cotton fabrics.

Indigo Blue Vat Blue

1.Name: indigo blue,vat blue 1,

2.Structure formula:

3.Molecule formula: C16H10N2O2

4.. CAS No.: 482-89-3

5.Molecule weight: 262.62

6.HS code: 3204151000

7.Major usage and instruction: Be mainly used to dye cotton fabrics.