vat indigo service

Understanding VAT on Indigo Services A Comprehensive Guide

Value Added Tax (VAT) is an indirect tax imposed on the sale of goods and services in many countries, including those that utilize Indigo services. Indigo, a leading low-cost airline in India, has made air travel more accessible to millions, but understanding how VAT applies to their services is crucial for both consumers and businesses alike. This article delves into the implications of VAT on Indigo services and its significance for passengers.

Understanding VAT on Indigo Services A Comprehensive Guide

For businesses that utilize Indigo services for corporate travel, the implications of VAT become even more significant. Companies may need to account for VAT on travel expenses, which can involve a meticulous process of collecting invoices and filling out the necessary paperwork for VAT recovery. Understanding the VAT system and its interplay with Indigo services can enhance financial planning and management for organizations. It may also help corporate clients take advantage of any potential tax benefits relevant to their travel expenditures.

vat indigo service

Moreover, the treatment of VAT can vary significantly depending on the type of service availed. For instance, if a passenger opts for additional services such as excess baggage, in-flight meals, or seat selection, these may also attract VAT. Thus, it becomes essential for travelers to be aware of these additional costs, as they can cumulatively inflate the total price of travel.

It’s also important to consider the geographical context when discussing VAT on Indigo services. Different countries have varying VAT rates and regulations that may affect travelers differently. For example, if an Indian resident travels to a foreign country and books a return flight with Indigo, the application of VAT can differ depending on the policies in place within the destination country.

In summary, understanding VAT on Indigo services is integral for both individual travelers and businesses. It impacts ticket pricing, travel expense management, and overall financial planning. To navigate the sometimes complex landscape of VAT, travelers are encouraged to stay informed about applicable rates and regulations, ensuring that they can budget accurately and make the most of their travel investments. Whether you are flying for business or leisure, a thorough understanding of VAT implications allows for a smoother travel experience and helps avoid unexpected expenses along the way.

-

The Timeless Art of Denim Indigo Dye

NewsJul.01,2025

-

The Rise of Sulfur Dyed Denim

NewsJul.01,2025

-

The Rich Revival of the Best Indigo Dye

NewsJul.01,2025

-

The Enduring Strength of Sulphur Black

NewsJul.01,2025

-

The Ancient Art of Chinese Indigo Dye

NewsJul.01,2025

-

Industry Power of Indigo

NewsJul.01,2025

-

Black Sulfur is Leading the Next Wave

NewsJul.01,2025

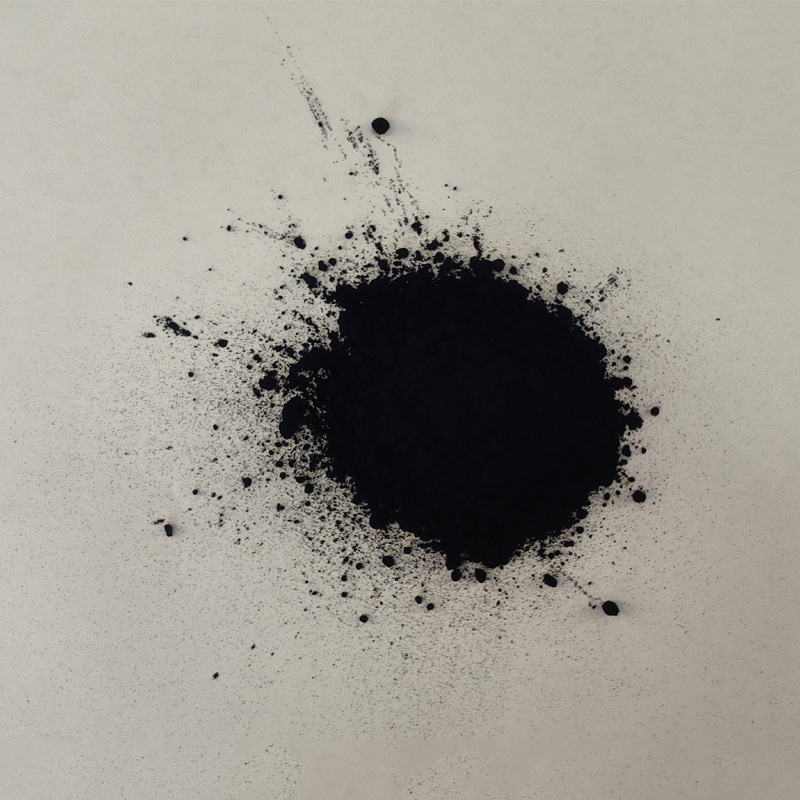

Sulphur Black

1.Name: sulphur black; Sulfur Black; Sulphur Black 1;

2.Structure formula:

3.Molecule formula: C6H4N2O5

4.CAS No.: 1326-82-5

5.HS code: 32041911

6.Product specification:Appearance:black phosphorus flakes; black liquid

Bromo Indigo; Vat Bromo-Indigo; C.I.Vat Blue 5

1.Name: Bromo indigo; Vat bromo-indigo; C.I.Vat blue 5;

2.Structure formula:

3.Molecule formula: C16H6Br4N2O2

4.CAS No.: 2475-31-2

5.HS code: 3204151000 6.Major usage and instruction: Be mainly used to dye cotton fabrics.

Indigo Blue Vat Blue

1.Name: indigo blue,vat blue 1,

2.Structure formula:

3.Molecule formula: C16H10N2O2

4.. CAS No.: 482-89-3

5.Molecule weight: 262.62

6.HS code: 3204151000

7.Major usage and instruction: Be mainly used to dye cotton fabrics.