Wholesale Indigo Blue VAT - Premium Bulk Fabric Supplier

Understanding Wholesale VAT on Indigo Blue Products

Understanding Wholesale VAT on Indigo Blue Products

VAT, a consumption tax levied on products at each stage of the supply chain, can have significant consequences for wholesalers. Typically, when a business purchases indigo blue products, it needs to add the applicable VAT rate to the selling price. This tax is determined by the country in which the transaction occurs, as VAT rates vary globally, often ranging from 5% to 25%. Understanding these rates is crucial for wholesalers dealing in indigo blue products to ensure compliance and avoid discrepancies.

wholesale vat indigo blue

When purchasing wholesale indigo blue items, wholesalers can usually reclaim the VAT they paid when they sell those products. This system is known as input tax recovery. For instance, if a wholesaler buys indigo-dyed textiles with a VAT of 20% and then sells them to retailers or directly to consumers, they can deduct the amount of VAT they previously paid from the VAT they collect on their sales. This helps maintain cash flow and minimizes the tax impact on the business.

Another vital consideration is the categorization of products. Some indigo blue goods may fall under reduced VAT rates or exemptions depending on their nature and usage. For example, certain clothing or handcrafted items may qualify for a lower VAT rate. Wholesalers must stay informed about the specific regulations applicable to their products to optimize their tax situations.

In conclusion, understanding the wholesale VAT implications of indigo blue products is essential for wholesalers to manage costs and maintain profitability. By staying informed about VAT rates, reclaim processes, and product categorization, businesses can navigate the complexities of tax regulations effectively. As the demand for indigo blue items continues to grow across various sectors, savvy wholesalers can leverage their knowledge of VAT to enhance their competitive edge while ensuring compliance with tax laws.

-

The Timeless Art of Denim Indigo Dye

NewsJul.01,2025

-

The Rise of Sulfur Dyed Denim

NewsJul.01,2025

-

The Rich Revival of the Best Indigo Dye

NewsJul.01,2025

-

The Enduring Strength of Sulphur Black

NewsJul.01,2025

-

The Ancient Art of Chinese Indigo Dye

NewsJul.01,2025

-

Industry Power of Indigo

NewsJul.01,2025

-

Black Sulfur is Leading the Next Wave

NewsJul.01,2025

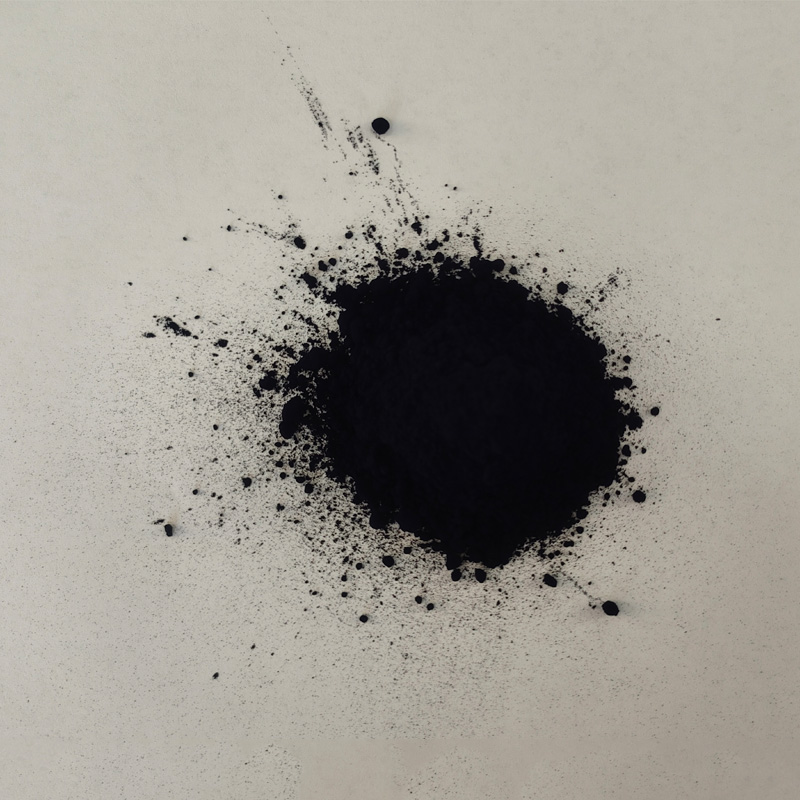

Sulphur Black

1.Name: sulphur black; Sulfur Black; Sulphur Black 1;

2.Structure formula:

3.Molecule formula: C6H4N2O5

4.CAS No.: 1326-82-5

5.HS code: 32041911

6.Product specification:Appearance:black phosphorus flakes; black liquid

Bromo Indigo; Vat Bromo-Indigo; C.I.Vat Blue 5

1.Name: Bromo indigo; Vat bromo-indigo; C.I.Vat blue 5;

2.Structure formula:

3.Molecule formula: C16H6Br4N2O2

4.CAS No.: 2475-31-2

5.HS code: 3204151000 6.Major usage and instruction: Be mainly used to dye cotton fabrics.

Indigo Blue Vat Blue

1.Name: indigo blue,vat blue 1,

2.Structure formula:

3.Molecule formula: C16H10N2O2

4.. CAS No.: 482-89-3

5.Molecule weight: 262.62

6.HS code: 3204151000

7.Major usage and instruction: Be mainly used to dye cotton fabrics.